Feb 28, 2023

China’s Growth Target, Stimulus in Focus for New Leadership

, Bloomberg News

(Bloomberg) -- After three years of turbulence under the Covid pandemic, China’s leaders are expected to lay out economic goals to get growth back on track, restore confidence and avoid a build-up of financial risks.

Economists expect Premier Li Keqiang — who will deliver his last government work report on Sunday when the annual National People’s Congress kicks off — to outline a target for gross domestic product growth for this year of higher than 5%. That’s after the economy expanded just 3% last year, missing the official goal by a wide margin.

The economic recovery is likely to come from a pickup in consumer spending and a return to normal for many businesses after years of Covid controls, rather than another big stimulus package. Faster growth this year may in fact prompt the central bank to move to a more neutral policy stance from its easing bias.

So far, the economy has shown encouraging signs. New surveys for February showed manufacturing activity recovering more strongly than expected, lending hope to the idea that the recovery is gaining momentum. Home sales rose for the first time since 2021, spurring optimism about returning demand.

A sustained rebound is far from certain, though. Export demand continues to languish and the property market has yet to stabilize. Key to the outlook will be how fast business and consumer confidence can bounce back from very low levels.

This year’s congress also takes on an added significance as it will usher in a new set of leaders responsible for economic policy — like the premier and economic czar — who are now closely tied to President Xi Jinping. Analysts are watching for any possible policy shifts.

Here are some of the key issues to watch in the government’s work report, scheduled for release on Sunday, March 5:

A growth target above 5%

The centerpiece of the government report would be the GDP growth target, a figure that’s used by other government agencies and local authorities for their planning.

Of the 24 economists surveyed by Bloomberg, eight expect the government to adopt a growth target of “above 5%” and eight predict “around 5.5%.” Five of those surveyed see a lower target of “around 5%” and only one forecasts “above 6%.”

A relatively conservative target would be easily achievable and leaves room for the government to exceed the goal, considering a low base of comparison from last year. An optimistic target — of 6% or above — would suggest Beijing is determined to ramp up growth support, which could help lift market confidence.

The economy is forecast to expand 5.2% in 2023, according to a Bloomberg survey of economists, compared with just 3% growth last year, which was the second-slowest pace since the 1970s.

The Central Economic Work Conference in December already hinted at more business-friendly policies and a focus on reviving domestic spending and confidence this year.

“In this context, we expect the government to set reasonable and ambitious economic targets to stabilize market expectations,” Standard Chartered Plc. economists including Ding Shuang wrote in a note.

Muted monetary and fiscal stimulus

Authorities are likely to keep monetary and fiscal policy supportive this year, while at the same time avoiding any big stimulus that could fuel inflation and debt down the road, economists said. That means the People’s Bank of China could keep banks relatively flush with cash, possibly reduce the reserve requirement ratio for banks again or make use of its structural tools to spur lending.

If the economy rebounds faster than expected, the central bank could shift tack, moving to a neutral policy stance. That would imply keeping interest rates and the RRR unchanged, as well as guiding credit and money supply growth so they trend lower and expand in line with nominal GDP. Fiscal stimulus could also be scaled back.

Economists surveyed by Bloomberg expect the government to set a deficit target for the general budget at 3% of GDP, slightly higher than the 2.8% set last year. The quota for special local government bonds, the main source of infrastructure funding, is likely to be 3.8 trillion yuan ($548 billion), a modest rise from the 3.65 trillion yuan in 2022, the survey showed.

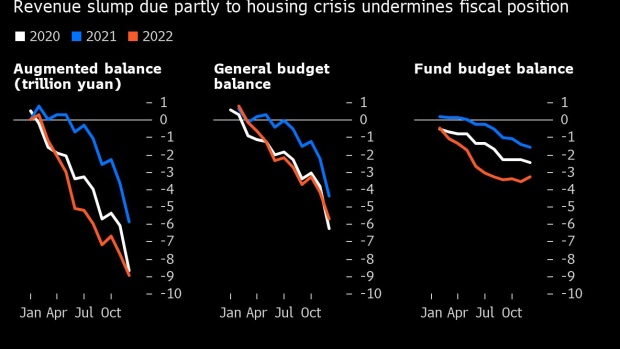

Officials may also offer less tax breaks and rebates — which reached a record 4.2 trillion yuan in 2022 — after the broad measure of fiscal deficit surged to a record 8.96 trillion yuan last year due to slowing growth, spending on Covid controls and plunging land sale income.

Expectations for the PBOC to cut policy interest rates in the short term is declining, after the central bank gave a more positive outlook of the economy and vowed to provide “sustainable” support to growth.

“The room for policy rate cut is very slim in our view,” Citigroup Inc. economists including Yu Xiangrong wrote in a report Sunday. “Staying alert to inflation risk, the PBOC could switch to a ‘wait-and-see’ mode quickly if growth is back on track and prepare for policy normalization.”

Plans for driving consumption

Top leaders may play up any measures intended to lift consumer confidence and private investment, given the focus this year on boosting domestic demand. So far that talk has been mostly limited to broad pledges to drive demand — making any detailed plans at the NPC key to look out for.

Unlike in the US and elsewhere, China has shunned stimulus checks and consumer subsidies as a way to fuel the post-pandemic economic recovery.

The government is clearly concerned about how to boost spending: Xi vowed in December to increase resident income, putting a particular focus on low- and middle-income households that have the propensity to spend but which have been greatly affected by the Covid pandemic.

While Xi cited “multiple channels” by which that income can be improved, though, he offered little in the way of specific detail.

The recovery has so far appeared uneven, with services activity picking up but spending on big-ticket items like cars and homes remaining weak. It may still be another month or so before the trajectory of the consumption rebound becomes clearer.

Still, many economists are betting on a pickup this year, including JPMorgan Chase & Co. economist Zhu Haibin. He projects that consumption will contribute 4.1 percentage points to GDP growth this year, compared to just one point last year.

Further support for property market

A stable property market will be key for China’s recovery this year, given the sector’s weight in the national economy, estimated to be anywhere from about 15% to 25% of GDP.

The nation’s leadership is expected to stress support for meeting the basic need of its citizens and improving demand for housing. Helping developers fix their balance sheets and satisfying their financing needs are also likely to be priorities.

The government is likely to discuss the need to devote more resources toward developing a rental market that addresses housing issues among migrants and young people, too.

China isn’t likely to abandon its mantra that “houses are for living in, not for speculation” — a pledge Xi has been touting for years to enforce the idea that the housing market needs to avoid bubbles and that risks need to be curbed.

Xi has called for efforts to prevent systemic risks caused by the property sector, citing the impact that those could have on economic growth, employment, fiscal income, residential wealth and financial stability.

Beijing is also likely looking for ways to help developers smoothly transition away from a “high debt, high leverage, high turnover” model to something more sustainable.

There are tentative signs the housing market slump may be easing. Home sales by the 100 biggest real estate developers rose in February for the first time since June 2021, signaling a recovery in demand after the government boosted support for the industry.

New leaders coming in with close ties to Xi

The legislature is set to approve the appointments of a slew of senior officials — including the premier, vice premiers and ministers — in the final days of the NPC.

Li Qiang, a close ally and former subordinate of Xi, is expected to succeed Li Keqiang as the premier. He Lifeng, another longtime associate of Xi who runs the economic planning agency, will likely take on Liu He’s position as the vice premier overseeing economic work.

The PBOC is expected to have new leadership as well. Veteran banker Zhu Hexin is now being considered to replace Yi Gang, who dropped from a list of senior officials at the ruling party’s congress last year. He Lifeng may be appointed to the influential position of party chief at the PBOC, the Wall Street Journal has reported. Finance Minister Liu Kun could also step down.

Authorities are also considering reviving the long-disbanded Central Financial Work Commission, which would centralize decision-making of the financial system under the top leadership of the Communist Party, Bloomberg News reported last week.

(Updates with PMIs in the fourth paragraph.)

©2023 Bloomberg L.P.