Nov 2, 2021

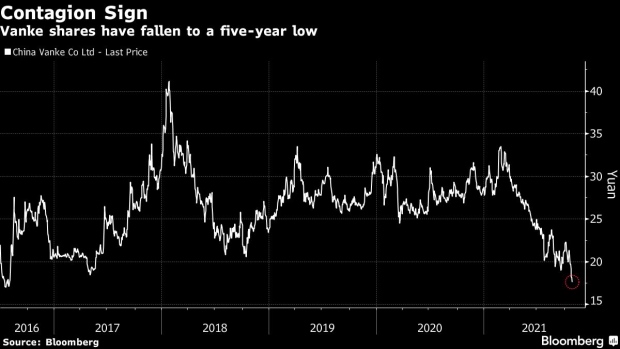

China’s Largest Developer at 5-Year Low Shows Stress Spreading

, Bloomberg News

(Bloomberg) -- If you want to see just how bad sentiment has gotten toward Chinese property firms, take a look at the share-price performance of China Vanke Co., the nation’s largest listed developer.

Vanke ranks among the minority of real estate firms that haven’t breached a single of the country’s “three red lines” on debt and leverage. The company remains profitable even as earnings and sales decline this year, with after-tax gross margin at 16%. Vanke had about 147 billion yuan ($23 billion) of cash on hand as of the end of September, with CICC analysts calling Vanke’s financials “solid” in a recent note.

None of that has helped the shares, which have plunged 17% in a seven-day rout in Shenzhen to their lowest level since August 2016. The losing streak mirrors a slump in the Shanghai property stock index.

News that the government plans to expand property tax trials to cities beyond Shanghai and Chongqing has frayed investors’ nerves at a time when the industry is being by tough rules on leverage and slumping sales. Officials have yet to provide details on where the tax will be levied or how large it will be. Residential prices fell for the first time in more than six years in September.

Yet Vanke’s year-to-date sales through October only fell 5%, according to a Citigroup Inc. note citing data from research firm China Real Estate Information Corp. The drop is 30% for China Evergrande Group and 13% for Guangzhou R&F Properties Co., the note showed.

Vanke’s dollar notes have remained resilient at par. Vanke is rated investment grade at Moody’s Investors Service, S&P Global Ratings and Fitch Ratings, with a stable outlook at all three credit assessors.

©2021 Bloomberg L.P.