Nov 14, 2022

China’s Property Woes Drive Household Savings to Record High

, Bloomberg News

(Bloomberg) -- Chinese households are putting money into time deposit accounts instead of buying property, a new study shows, driving savings to a record and underscoring the challenges policymakers face in spurring consumer spending in the economy.

The 13.2 trillion yuan ($1.8 trillion) jump in new household savings in the first nine months of the year was mainly driven by a 3.8 trillion yuan surge in time deposits compared with the two-year average level of 2020 and 2021, according to an analysis by Zhu He, deputy head of research at Beijing-based think tank China Finance 40 Forum.

Lower consumer spending -- which resulted in precautionary savings -- accounts for only about a quarter of the cash hoard, while the rest is explained by the drop in property purchases, Zhu said in a paper published Sunday. That shows households are increasingly allocating their assets in longer-maturity bank accounts instead of real estate, as home prices extend a record slide that has lasted for 13 straight months.

“The household sector is actively adjusting the structure of their family asset allocation,” said Zhu. “There is no reason to believe this process will stop in the absence of a fundamental reversal of household expectations” on the housing market, he said in the paper.

The trend highlights the obstacles policymakers face in spurring consumption and growth in the economy even as they take stronger steps to stabilize the housing sector. Authorities recently outlined a set of sweeping directives to bolster the property market that ranged from addressing developers’ liquidity crisis to loosening down-payment requirements for homebuyers.

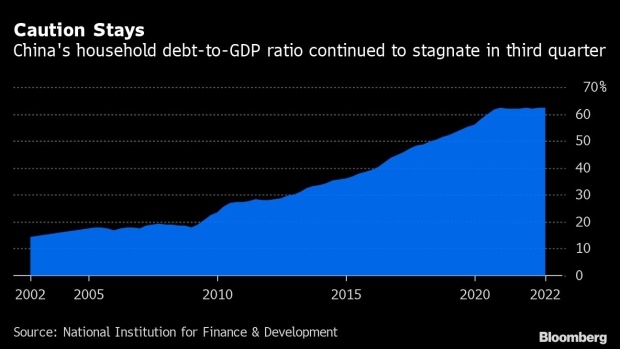

Apart from increasing savings, households continued to curb borrowing despite falling mortgage rates. The household debt-to-gross domestic product ratio barely budged in the third quarter, having stagnated around the 62% level since the third quarter of 2020 after a decade of rapid climb, according to data released last week by the National Institution for Finance & Development, a state think tank under the Chinese Academy of Social Sciences.

All of these indicators point to signs of a “balance-sheet recession,” where consumers are reluctant to borrow even as financing costs decline as they focus on boosting savings and repaying debt, researchers at the NIFD said in a report. The government should expand the budget deficit to increase official investment spending, which would lift corporate and household incomes, they said.

--With assistance from Tom Hancock.

©2022 Bloomberg L.P.