Nov 14, 2022

China’s Retail Sales Shrink as Covid Outbreaks Strain Economy

, Bloomberg News

(Bloomberg) -- China’s economic activity weakened in October, putting pressure on Beijing to ramp up support after it took major steps in the past week to reduce the drag on consumers from Covid Zero policies and a property slump.

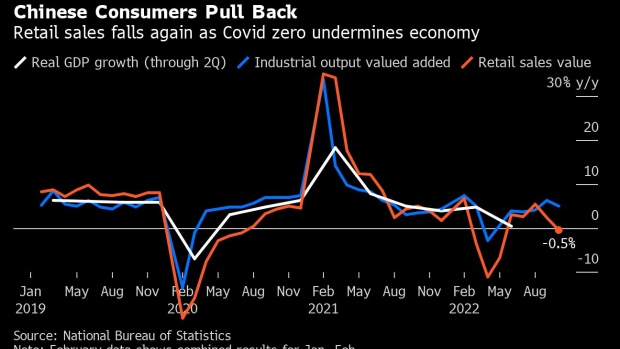

Retail sales contracted 0.5% in October from a year earlier -- the first decline since May and worse than economists’ expectations for 0.7% growth. Industrial output growth weakened, property investment continued to contract and the jobless rate remained high.

October saw a surge in Covid cases, with authorities tightening controls ahead of the Communist Party’s congress and discouraging travel during the weeklong National Day holidays.

With Covid infections continuing to spread in November -- including in major manufacturing hub Guangdong, where partial lockdowns have been imposed -- the growth outlook for the rest of the year remains grim.

Beijing recently took its strongest steps yet to stabilize the property market and reduce the economic burden of the Covid Zero policy, fueling investor optimism. However, any rebound won’t be felt for several quarters yet, and with economists expecting Covid disruptions to continue through next year, officials are under pressure to do more.

“Given the soft patch in October, policymakers could roll out more easing measures to stabilize the economy toward the year-end,” Macquarie Group Ltd. analysts led by Larry Hu wrote in a note. “China’s policymakers are set to miss this year’s growth target, but they might want to bring growth back to its potential” of over 5% next year, they wrote.

Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc, said significant easing of Covid restrictions likely won’t occur until the second quarter of next year and “so a meaningful rebound in consumption may only arrive in the second half of 2023.”

Chinese stocks continued to climb on Tuesday, with sentiment boosted by moves to ease the property crisis and signs of reduced US-China tensions. The benchmark CSI 300 Index of stocks gained 1.5% as of 1:44 p.m. local time, taking its rise this month to almost 10%. The yuan traded 0.32% stronger in the onshore market at 7.0482 per dollar.

Aside from Covid restrictions and the property crisis, other growth pillars are also struggling: bank lending is at the lowest in five years and exports declined in October for the first time since May 2020.

Infrastructure investment was a bright spot last month, expanding 8.7% in the first 10 months of the year from a year earlier, as the government ramps up stimulus. Property investment continued to weaken though, contracting 8.8% over the same period.

What Bloomberg Economics Says...

Covid Zero and a sinking property market “have made the recovery increasingly vulnerable, especially now that exports are contracting. The raft of policy shifts in recent days is unlikely to turn the tide immediately, but risks are now pointing more to the upside for next year’s growth.”

Eric Zhu, China economist

For the full report, click here

A breakdown of retail sales showed sales of household appliances and audio-visual equipment dropped the most in October, while sales of construction and decoration materials continued to fall sharply on a worsening property slump. Catering revenue plunged 8.1% last month, the most since May.

“It is clear that new policies to boost domestic demand are needed to refuel China’s fragile recovery,” said Bruce Pang, chief economist and head of research for Greater China at Jones Lang LaSalle Inc. “Sluggish consumption and faltering property investment remain dawdlers, due to still-weak expectations on household income and macro growth.”

Authorities are stepping up support measures to help businesses. On Monday, the central bank announced a loan repayment holiday for smaller companies that have been hit by Covid restrictions. The banking regulator also allowed property developers to access more of the money homebuyers pay in advance for homes.

The People’s Bank of China on Tuesday also ensured ample cash levels in the banking system to support the economy. Some economists also expect the PBOC to lower the reserve requirement ratio, or the amount of cash banks must keep in reserve, in coming months.

China is currently seeing the largest Covid outbreak since the spring, with 17,298 new cases on Monday despite lockdowns in some places, mass testing and other controls.

Unlike earlier in the year, when almost all confirmed cases were in Shanghai, every mainland province has now reported new cases over the past week, showing how widespread the outbreak is and how hard it will be to eradicate.

The nation’s growth prospects will largely hinge on whether the government steps up controls to try and contain this outbreak and what further steps it takes to fine-tune Covid policies. Economists surveyed by Bloomberg predict GDP growth will slow to 3.3% this year and rebound to 4.8% next year.

“The outlook is not as pessimistic because China is set to gradually relax Covid policies to boost domestic demand in coming months,” said Liu Peiqian, chief China economist at NatWest Group Plc.

--With assistance from Fran Wang.

(Updates with chart and more details on current Covid outbreak.)

©2022 Bloomberg L.P.