Dec 5, 2023

China Seen Targeting Ambitious 2024 Growth Goal at Key Meetings

, Bloomberg News

(Bloomberg) -- Two meetings of China’s top officials this month will be scrutinized by analysts and investors for signs the world’s second-largest economy is set to be more aggressive with its growth goal for 2024.

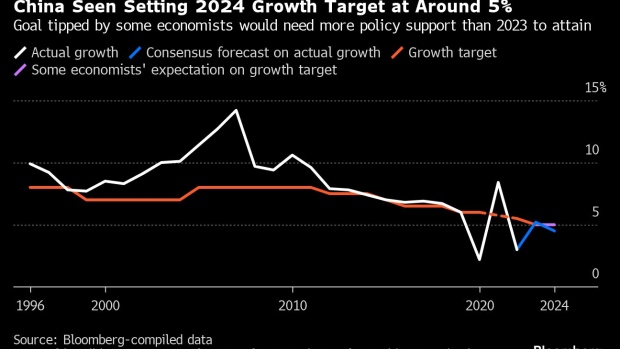

Expectations are high the nation’s leaders will discuss setting a new economic expansion target similar to this year’s goal of about 5%. Holding that target next year would be more aspirational, due to a higher base. It would also require an even greater focus on timely stimulus to combat drags from a persistent property slump, waning foreign demand and a gloomy job market.

“An ambitious growth target could help mitigate the risk of China falling into a self-fulfilling cycle of downbeat expectations, further depressing growth and reinforcing pessimistic expectations,” Goldman Sachs Group Inc. economists including Maggie Wei wrote in a Friday note.

The Communist Party’s 24-member Politburo is expected to gather soon to chart policy for next year. After that, specifics for growth and development will be discussed at the annual Central Economic Work Conference, which will bring together provincial and central government leaders. Any numeric annual goals will only be released in March.

Here’s a look at what to expect from this month’s policy talks:

GDP Target

The Goldman analysts foresee China targeting gross domestic product growth of around 5% in 2024. That’s the same as this year — though it would be much more aggressive, given 2023’s high base figures come after an anemic 2022 that was beset by pandemic outbreaks and restrictions.

Economists at several other investment banks — including JPMorgan Chase & Co., Standard Chartered Plc and local brokerages like Tianfeng Securities Co. — also see Beijing targeting the “around 5%” figure.

Given the economy may still exceed 5% expansion in 2023, achieving a similar rate next year would require more fiscal spending and a more flexible approach to monetary policy, whether by issuing extra government debt, pumping liquidity into financial markets or even cutting rates.

An “upbeat” growth goal of 4.5% or higher would help “guide expectations and boost confidence,” according to economists at Morgan Stanley. Targeting a rate that high would mean a “visible acceleration” in growth given the two-year compound annual growth rate in 2023 is estimated to be just around 4%, they wrote in a report last month.

Fiscal Stimulus

China began 2023 with a muted approach toward fiscal policy. The augmented deficit, a broad measure of the fiscal gap, shrank compared to last year partly because local authorities were no longer able to afford to offer massive tax breaks as in prior years.

Authorities have been stepping up fiscal stimulus in recent months by leveraging up the central government, giving debt-laden local authorities some respite. That’s a strategy economists expect to continue into 2024 as the government works to rebuild confidence.

The more forceful approach to fiscal support this year came via a rare move in October to raise the 2023 fiscal deficit to 3.8% of GDP. The boost to the ratio — well above the historically adhered-to limit of 3% — involved issuing more sovereign debt to support the economy through infrastructure investment.

Morgan Stanley expects the budget deficit-to-GDP ratio to reach 4% next year as officials issue even more government bonds.

Doing so may cushion the blow for local authorities from a national campaign to reduce the hidden debt they carry, since they now need to rely on other means to finance infrastructure projects to spur growth. It would also help combat the ongoing slump in the housing market.

Monetary Policy

The People’s Bank of China is seen keeping monetary policy loose in 2024 to help the economy and accommodate the additional liquidity needed to support more fiscal stimulus.

That means the language used to describe policy in readouts from the economic meetings this month will likely mirror that already in use: “targeted and forceful,” Tianfeng Securities economists wrote in a Monday note. Policymakers have been using that phrase for the past year as they focus on growth.

“The PBOC will likely need to maintain relatively loose monetary and liquidity conditions to accommodate relatively loose fiscal policy settings,” wrote Louise Loo, lead economist at Oxford Economics, in a Monday note.

What Bloomberg Economics Says ...

“2023 has been a year of dashed hopes for recovery in China. A deepening property slump that threatens to wipe out 5 million jobs suggests 2024 won’t be any easier. Growth will get a fiscal boost early in the year. Turning that into a durable revival will require private-sector confidence to return — a big open question.”

— Chang Shu, Eric Zhu and David Qu, economists

Read the full report here.

Analysts expect a bevy of actions by the central bank in the next few months to ease policy. That includes an anticipated cut to the reserve requirement ratio — the amount of cash lenders have to keep in reserve — to help banks buy up a surge in government bonds. The PBOC may also cut policy rates early next year, economists predict.

Investors are also looking to see whether the central bank will introduce more targeted policies to help the ailing property sector. One option is a relaunch of Pledged Supplementary Lending, a program the PBOC has in the past used to provide cheap loans to policy banks to fund construction for housing and other projects.

Property Lifelines

The health of the real estate sector remains a key challenge for the government. In the coming year, economists say authorities are likely to reaffirm the importance of “big projects” such as the creation of social housing and the renovation of run-down inner city districts to help the property market stabilize.

That focus was underscored by President Xi Jinping’s recent visit to a subsidized rental apartment complex in Shanghai. Such projects could help narrow the decline in housing construction and investment.

Authorities may also signal a further relaxation of home purchase rules to support sales. Prior attempts to loosen such policies have yet to put a floor under the market’s collapse.

“Priorities for next year should include reducing financial risks stemming from developer and local government debt,” Pantheon Macroeconomics Ltd. economist Duncan Wrigley wrote in a Friday note.

©2023 Bloomberg L.P.