Oct 25, 2022

China Stocks Climb as Authorities Seek to Boost Confidence

, Bloomberg News

(Bloomberg) -- Just as Chinese stocks were showing signs of a revival after Monday’s historic rout, traders were reminded of the fragility of a market that’s been bogged down by President Xi Jinping’s Covid-Zero policy.

As reports of a lockdown in one of Wuhan city’s central districts filtered through trading rooms, equity gauges in China and Hong Kong pared more than half of their advance. An index of Casino shares also erased most of its gains as Macau reported one Covid case.

While other countries reopen, Xi’s relentless pursuit of Covid Zero almost three years since the pathogen first emerged in the city of Wuhan has squeezed economic growth and made Chinese stocks one of the world’s worst performers this year. With the president tightening his grip after a leadership meeting, expectations of a pivot have been scaled back.

READ: Macau Announces Mass Covid Testing Plan in Some Areas

The new lockdown shows the “Covid-zero policy is here to stay and may only be changed gradually,” said Marvin Chen, an analyst with Bloomberg Intelligence. “Risks such as Covid Zero are becoming ingrained in the rising country-risk premium for China, which is something investors will have to weigh against historically low valuations.”

The Hang Seng China Enterprises Index finished just 0.7% higher in Hong Kong on Wednesday after rallying 2.6% earlier in the session amid efforts by authorities to bolster investor confidence. China’s benchmark CSI 300 Index pared more than half of its early advance to end up 0.8%.

The gauge of Chinese stocks listed in Hong Kong climbed 1.3% in the previous session. That followed a plunge of more than 7% on Monday, the steepest since 2008, as the party congress left investors dismayed due to a lack of supportive policies and the absence of a concrete plan to spur the economy.

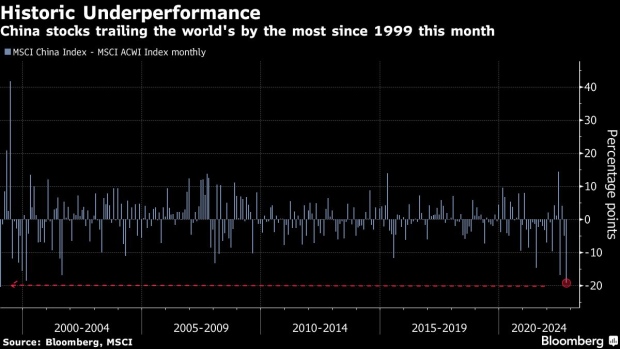

The MSCI China Index is on track to underperform a gauge of global stocks by the most since 1999 this month. Global money managers are “frustrated and angry,” according to Bank of America, as Xi seeks to exert greater state control over markets and the economy.

Words of Support

China’s central bank and foreign-exchange regulator said Tuesday that they would maintain the healthy development of stock and bond markets. The China Securities Regulatory Commission said in a separate statement that it will accelerate the building of capital markets that are “regulated, transparent, open, robust and resilient.”

To be sure, comments by the PBOC and CSRC were made at meetings held by financial regulators earlier in response to the 20th party congress, which concluded on Sunday, rather than in reaction to the slump in China’s financial markets this week.

Meanwhile, the Financial News, a newspaper published by the People’s Bank of China, ran an article in Wednesday’s edition, calling attention to optimism among local and international investors on the country’s mainland stock market.

Earlier, news about Monday’s market rout was mostly absent from China’s top securities newspapers the following day, with front pages dedicated to other key meetings and events following the Party congress.

Overall, optimism remains in short supply for China’s markets, with the MSCI gauge’s plunge of more than 60% since February 2021 nearing the magnitude of losses seen in the equity rout during the global financial crisis. Goldman Sachs Group Inc.’s China-focused stock hedge fund clients had their second-worst trading day this year during Monday’s selloff.

Meituan and Tencent Holdings Ltd. were the biggest contributors to gains on the HSCEI gauge on Wednesday. The Hang Seng Tech Index ended 2.5% higher while Hong Kong’s benchmark measure was up 1%.

“It is more likely a technical rebound today than one driven by fundamentals,” said Willer Chen, an analyst at Forsyth Barr Asia Ltd.

--With assistance from Jeanny Yu.

(Adds details on hedge fund losses in third last paragraph. An earlier version of hte story corrected Xi’s title in third paragrah.)

©2022 Bloomberg L.P.