Dec 12, 2023

China Wraps Key Economic Meeting to Determine 2024 Growth Goal

, Bloomberg News

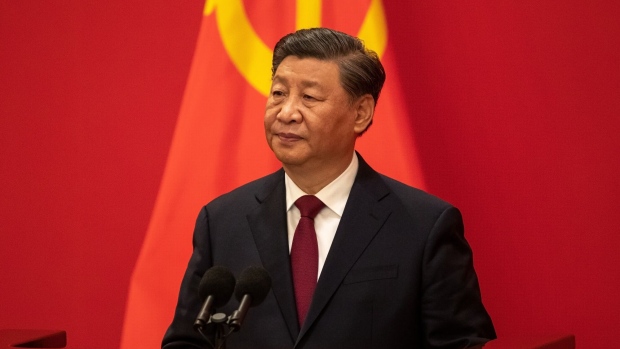

(Bloomberg) -- China’s top leaders including President Xi Jinping vowed to make industrial policy their top economic priority next year, a letdown for investors hoping to see more forceful stimulus to boost growth.

The ruling Communist Party’s annual economic work conference made building a “modern industrial system” its No. 1 goal, up a place from last year. The priority for 2023 was boosting domestic demand, which fell to the second spot as policymakers put greater emphasis on developing cutting-edge technology and artificial intelligence.

The language on housing was little changed from previous statements, with an emphasis on social housing, while no new remedies in offer for the faltering property sector.

“The measures sound rather traditional and nothing much was very creative,” said Jacqueline Rong, chief China economist at BNP Paribas SA. “Investors’ reaction to this might be rather plain because it takes an indication of a vastly stronger-than-expected pro-growth policy to trigger very excited response.”

A gauge of Chinese stocks listed in Hong Kong lost as much as 1.6% on Wednesday. Developers Longfor Group Holdings Ltd. and China Overseas Land & Investment Ltd. were among the worst performers. The CSI 300 benchmark of onshore equities slid 1.5% as foreign investors sold more than 10 billion yuan ($1.4 billion) of the shares, set for the worst daily outflow in nearly two months.

The muted reaction suggests the doom and gloom in Chinese markets may extend into next year. Stocks have failed to regain their appeal after a reopening rally at the start of this year petered out, with gauges in Hong Kong among the world’s worst-performing benchmarks in 2023. Portfolios that exclude China are on the rise.

The two-day confab that wrapped Tuesday took place as China reaches a critical crossroads. Xi is searching for new growth engines to sustain the economy, as a lingering crisis deepens in the traditionally important property market. Weak domestic demand, local debt risks and sluggish exports have also made China’s post-pandemic rebound elusive, as the Asian giant slides into deflation.

The meeting’s emphasis on supporting companies to produce higher-value products above trying to spur consumer spending is unlikely to significantly juice growth in the near-term. Ramping up manufacturing also risks inflaming geopolitical tensions, as the European Union warns China against flooding the market.

“I don’t see any signs of large-scale stimulus,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc. The meeting showed that “technology self-reliance is more important” than in previous years.

Another thing missing from the event was Xi himself on the final day. The second half of the conference overlapped with the Chinese leader’s two-day trip to Vietnam, marking the first time he’s traveled abroad during the economic meeting, according to his public schedule.

Weak Expectations

China’s top leaders acknowledged “lackluster social expectations” for the economy this year, as confidence remains muted after years of Covid controls. But while they nodded to challenges that had dragged on growth, the ruling party sought to boost morale for 2024.

“Favorable conditions outweigh unfavorable factors in China’s development,” they said, according to the read out. “The fundamental trend of the economic recovery and long-term positive outlook has not changed.”

Beijing is on target to meet its conservative annual growth goal of about 5% this year, with the focus now shifting to what tools Xi will use to try to maintain that pace in 2024. Moody’s Investors Service cut its outlook for Chinese sovereign bonds to negative last week, underscoring concerns about debt levels as Beijing leans on fiscal policy.

What Bloomberg Economics Says ...

The annual meeting acknowledged many familiar challenges — such as weak domestic demand, sluggish consumption, and property and local debt risks — but didn’t prescribe new remedies or offer any quick fixes. Nothing we see in the priorities policymakers set for next year shifts our view on the growth and policy outlook.

— Eric Zhu, economist

Read the full report here

This week’s confab called for “appropriately stepped up” fiscal measures, as well as “prudent” monetary policy — that echoed a huddle of the party’s 24-member Politburo last week, which was seen as taking a pro-growth stance.

That conclave also upgraded the importance of making economic “progress,” raising expectations the official GDP growth target will be kept around 5% next year. In practice, that would be more ambitious than this year’s goal, partly because the consumption rebound from the end of Covid restrictions has largely played out.

Officials this week also said the pace of credit growth should be in step with both the GDP and inflation targets. Economists said that could mean monetary easing next year to offset deflation, which has led to higher “real” or inflation-adjusted interest rates this year.

“Monetary policy could turn more accommodative in the face of deflationary risks,” implying more cuts to interest rates and bank reserve requirements in the year ahead, Larry Hu, head of China economics at Macquarie Group Ltd., wrote in a note.

While leaders offered reassurances around the key pain points in China’s economy — such as record high youth unemployment and developers on the verge of default — they skipped proposing any big solutions.

The meeting pledged to meet property developers’ reasonable financing needs, ensure employment for “key groups” of people, and maintain ample liquidity.

The lack of new discussion around the property sector could be disappointing to some investors, according to Goldman Sachs analysts including Maggie Wei and Hui Shan. This may suggest policymakers are still exploring ways to stabilize the sector. A Bloomberg Intelligence gauge of developer shares dropped as much as 3.4% on Wednesday.

There were some signals of incremental change. Policymakers hinted at consumer goods measures that sparked expectations for household subsidies to buy appliances, cars and furniture to spur consumption. There was also a vague vow to launch a “new round of tax reform.” Tax cuts were mentioned, in a departure from last year.

Compared to last year’s work conference, there was more emphasis on economic problems caused by a supply-side focus. The report also warned that the “complexity, severity and uncertainty of the external environment is rising.”

That was likely a veiled reference to geopolitical headwinds. The US has imposed sweeping curbs on China’s access to cutting-edge chips, as tensions simmer between the world’s two largest economies, increasing Xi’s focus on homegrown innovation.

“China’s policymakers firmly believe that developing new technologies, upgrading existing industries and fostering new emerging sectors are key to enhance prosperity and productivity,” said Duncan Wrigley, chief China economist at Pantheon Macroeconomics. “This strategy carries geopolitical risks.”

--With assistance from Philip Glamann.

(Updates market reaction in fourth paragraph.)

©2023 Bloomberg L.P.