Jan 21, 2024

Chinese Banks Maintain Lending Rates After PBOC Policy Rate Hold

, Bloomberg News

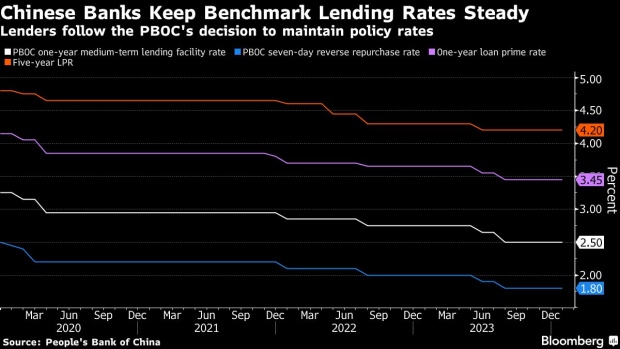

(Bloomberg) -- China’s commercial lenders held their benchmark lending rates in line with the central bank’s recent move to maintain borrowing costs, as attention shifts toward the likelihood of more easing in the coming months.

The one-year loan prime rate was kept at 3.45%, matching the consensus forecast among economists surveyed by Bloomberg. The five-year rate — a reference for mortgages, was also held at 4.2% as projected — data from the People’s Bank of China showed. Last week, the PBOC refrained from trimming the rate on its one-year policy loans.

Beijing has been reluctant to flood the economy with monetary stimulus despite the nation experiencing its longest deflationary streak since the late 1990s. While cutting rates can boost dwindling confidence, policymakers have to balance any easing with the need to guardrail the nation’s massive banking system and safeguard the yuan. The Federal Reserve’s next moves are also a factor, with the US central bank recently pushing back against speculation for rate cuts as soon as March.

“Banks are not ready to cut in January, “ said Xing Zhaopeng, senior China strategist at Australia & New Zealand Banking Group Ltd. He also cited a deterioration in net interest margins for banks as a “big concern.” Those pressures suggest lenders may need more time to reduce their funding costs before being able to absorb the impact of lower borrowing rates.

Chinese stocks traded slightly lower Monday morning to under-perform against their regional peers. The onshore benchmark CSI 300 Index lost as much as 0.5%, compared to a 0.7% gain in the MSCI Asia Pacific Index.

The Chinese yuan was little changed both onshore and offshore, though has slipped for three consecutive weeks as the US dollar gains strength. The yields on 10-year China government bonds were little changed at 2.5%.

The steady rates also illustrate a desire to ensure the existing amount of credit within the financial system is used efficiently. Fast-growing money supply has yet to translate into a significant improvement in actual borrowing.

The LPRs are based on the interest rates that 20 banks offer their best customers. They are quoted as a spread over the central bank’s one-year policy rate, or the medium-term lending facility rate. The PBOC, which publishes the LPRs monthly, is seen as having significant sway over them.

Investors have so far been underwhelmed by Beijing’s policies to keep economic momentum going. Official data released last week failed to shake off several of the concerns most persistently weighing on the world’s second-largest economy. While China hit its roughly 5% growth target last year, it’s recording its worst deflationary streak since the Asian Financial Crisis. Home prices fell last month by the most since 2015, underscoring the scale of the real estate crash.

Analysts do expect the central bank to eventually ease policy through rate cuts or trims to the reserve requirement ratio, the amount of cash banks must keep in reserve, though the timing of such actions is up for debate.

Raymond Yeung, ANZ’s chief economist for greater China, said he sees a RRR cut happening before the lengthy Lunar New Year celebrations in February. He also expects the PBOC to reduce the rate on its one-year policy loans in April at the earliest.

What Bloomberg Economics Says ...

“We see the PBOC trimming rates by 10 basis points this quarter, which should lead broader lending rates down as well. Sluggish growth and increasing deflationary pressure show the economy needs stronger policy support — and quickly. An expected cut in the PBOC policy rate would give banks room to trim lending rates.”

— Eric Zhu, economist

Click here to read the full report.

Serena Zhou, senior China economist at Mizuho Securities Co., is expecting interest rate and RRR cuts — though she sees those moves more likely after China’s leaders hold their annual legislative sessions in early March.

That will be “when China has a more coordinated plan for bolstering the economy,” she said, adding that the Fed will likely give “a more clear road map in terms of cutting rates,” which will help avoid pressuring the yuan further.

Yeung, though, cautioned that interest rate cuts are a “little step” that wouldn’t be enough to solve the nation’s deflationary pressures.

“The key remains to stabilize the property market and defend asset prices,” he said. “Structural measures are needed.”

--With assistance from Iris Ouyang and Zhu Lin.

(Updates with additional comments throughout.)

©2024 Bloomberg L.P.