Dec 12, 2023

Chinese Stocks Fall as Key Economic Meeting Disappoints

, Bloomberg News

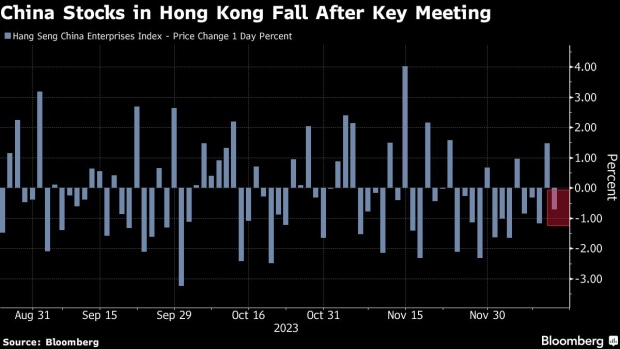

(Bloomberg) -- Chinese stocks fell as a key economic meeting disappointed investors with its lack of emphasis on fixing real estate woes or offering greater stimulus.

The Hang Seng China Enterprises Index lost as much as 0.9%, with developers Longfor Group Holdings Ltd. and China Overseas Land & Investment Ltd. among the worst performers. The CSI 300 benchmark of onshore shares slid 0.8%.

China’s top leaders including President Xi Jinping concluded the annual economic work conference on next year’s priorities, emphasizing industrial policy and technological innovation. There were few signs that policymakers are planning large-scale stimulus or new remedies for the ailing property sector, which let down investors looking for new catalysts.

READ: China Puts Focus on Industrial Policy, Skips Big Demand Stimulus

Policymakers pledged to meet property developers’ reasonable financing needs, ensure employment for “key groups” of people, and maintain ample liquidity. The language on housing was unchanged from previous statements, with an emphasis on social housing.

Property woes have been a major drag on the equity market this year. A Bloomberg Intelligence gauge of developer shares has lost nearly half its value so far in 2023 amid a deepening sector slump and regulators’ reluctance to roll out bold rescue measures.

“There was no surprise from the conference,” said Hao Hong, chief economist at Grow Investment Group. “Some may be disappointed by not seeing specific stimulus package coming out of the meeting. The focus on security and risk, as well as high quality development, naturally implies that at this stage high quality growth trumps fast growth.”

--With assistance from Charlotte Yang.

©2023 Bloomberg L.P.