Mar 12, 2024

Country Garden Misses Yuan Bond Coupon Payment for First Time

, Bloomberg News

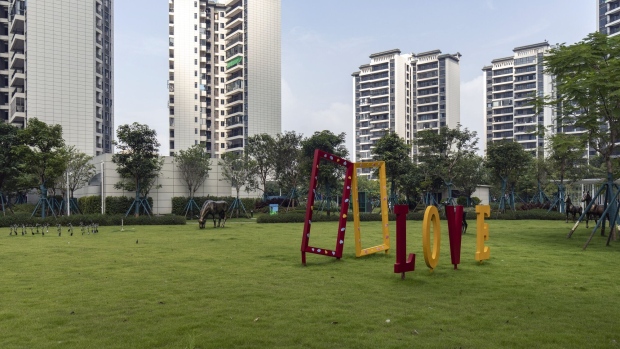

(Bloomberg) -- Country Garden Holdings Co. missed a coupon payment on a yuan bond for the first time, adding to the woes of the Chinese developer that is facing a lawsuit seeking its liquidation offshore.

The builder’s main onshore unit hasn’t fully prepared a 96 million yuan ($13 million) coupon that came due on Tuesday for a 4.8% yuan bond maturing in 2026, the company said in a response to Bloomberg. There is a 30 trading-day grace period for the payment, it added.

“Sales recovery has fallen short of expectations, so fund allocation remains under pressure,” Country Garden said in the statement. “The company will make all efforts possible to raise cash during the grace period, including through sales, asset disposal and expenditure cuts.”

Country Garden roiled markets when it defaulted on its dollar debt in October, but has so far managed to avoid doing so on its local-currency obligations. In September, the developer extended more than 10 billion yuan of yuan bonds by three years. After that, it paid several coupons and in December paid off an 800 million yuan note.

The developer’s shares snapped a three-day advance on Tuesday, falling 4.9% to 58 Hong Kong cents. Its dollar bonds still trade at deeply distressed levels of around 8 cents on the dollar.

Country Garden’s crisis entered a new chapter after a Hong Kong court last month received a creditor’s petition to wind up the Guangdong-based company. The lawsuit may add to pressure on the developer to advance a debt restructuring plan.

A sales drought for the builder has worsened. Contract sales for February plunged 85% from a year earlier, widening from a 75% slide in January, corporate filings show.

Homebuyers in China are avoiding defaulted developers on concerns about their ability to complete housing projects. Now the focus is turning to China Vanke Co., a state-backed builder that is in talks with creditors to stave off a default.

--With assistance from Shuiyu Jing.

(Updates with company statement in the second and third paragraphs.)

©2024 Bloomberg L.P.