Oct 24, 2023

Crypto Delistings From Exchanges Are Already Running at a Record Pace This Year

, Bloomberg News

(Bloomberg) -- Even as Bitcoin stages an astonishing resurgence, a record amount of digital tokens are being delisted this year from exchanges such as Coinbase Global Inc. and Binance.

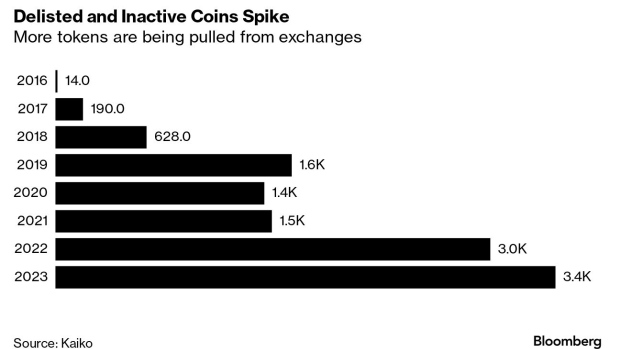

At least 3,445 tokens or trading pairs have been delisted or inactive for so long that they’ll likely be dropped in the wake of the turmoil in the cryptocurrency market over the past few years, according to data compiled by Kaiko. That’s already 15% higher than for all of 2022, and double the amount the prior year, the researcher found.

Coinbase and Binance have dropped more than 100 tokens this month alone. In fact, Coinbase delisted 80 pairs so far in October, more than in any other month this year, and since at least 2021, according to researcher CCData. Exchange OKX has already delisted 172 tokens this year, while Coinbase has delisted 176 pairs, per CCData.

Trading volume on most exchanges has plummeted in the past year, even as the number of coins has continued to multiply, with more than 1.8 million tokens listed on centralized and decentralized exchanges, which let users trade with each other directly. As liquidity drained from the crypto market after a series of scandals and bankruptcies such as FTX, many exchanges moved to consolidate it among trading pairs that are more popular with users.

“Eliminating fragmented liquidity offers a better trading experience to users by reducing the spread and slippage costs,” said Jacob Joseph, an analyst at CCData.

Recent regulatory actions have contributed to the delistings as well. The US Securities and Exchange Commission designated 19 tokens as unregistered securities in its lawsuits against Coinbase and Binance in June, and many exchanges have been getting out of trading them, so as not to incur the agency’s ire.

The delistings are picking up even with most cryptocurrencies rebounding in part from widespread losses seen in 2022. A gauge of the 100 largest tokens has jumped around 60% since December, after tumbling 66% in the prior calendar year.

Bitcoin, which now accounts for more than half the $1.3 trillion crypto market capitalization, has surged almost 30% in the past two weeks amid growing optimism an exchange-traded fund that invests in the cryptocurrency may be approved in coming months. The market bellwether has more than doubled this year to around $34,500, after tumbling 64% in 2022. It reached a record of almost $69,000 in late 2021.

Delistings have long been part of the crypto landscape. During the previous bear market in 2018, hundreds of tokens were declared dead. The carnage was mostly the consequence of failed projects from the thousands of startups that used initial coin offerings to raise billions in funding, and an earlier global regulatory crackdown on questionable practices and scams.

“This is the result of an explosion in the number of tokens, as well as aggressive listing of these tokens, during the last bull market,” said Riyad Carey, an analyst at Kaiko. “Many of these tokens/projects have faded away or folded in the bear market and liquidity and volumes are at multi-year lows, and exchanges will delist pairs that don’t generate enough in fees.”

©2023 Bloomberg L.P.