Mar 4, 2022

Czechs Intervene to Prop Up Currency, Joining Regional Push

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

The Czech central bank began intervening to support the koruna, joining other eastern European peers in defending their currencies as they depreciate due to risks from Russia’s invasion of Ukraine.

Poland’s central bank was also in the market on Friday morning, according to people familiar with transactions, its third intervention this week as the zloty tumbled to levels not seen since 2009.

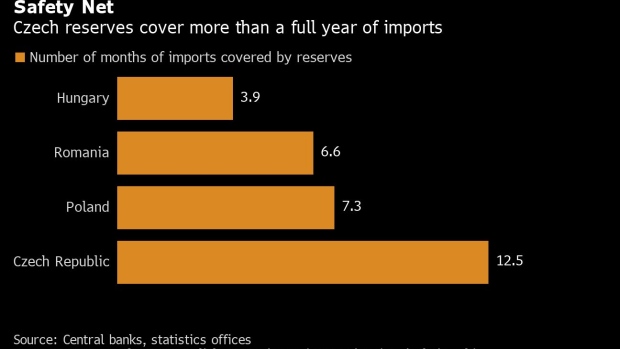

While east European currencies are among the worst hit by the crisis, the region’s central banks have amassed hefty international reserves, led by the Czechs with enough foreign assets to cover more than a year of imports.

“By international comparison, the Czech National Bank has high international reserves,” the monetary authority in Prague said in a statement. “Their use in the current exceptional situation is fully justified.”

The koruna advanced as much as 0.9% after the announcement and pared some gains later to trade at 25.611 to the euro at 10:27 a.m. in Prague. The CNB said it won’t publish details of the market interventions.

Poland’s zloty reversed a drop to 4.868 per euro in early trading Friday after the central bank stepped in. The forint traded slightly weaker after Hungary hoisted interest rates more than expected on Thursday.

Since Russia’s invasion of Ukraine on Feb. 24, only the ruble has depreciated more than the forint, koruna and zloty among the 31 major currencies tracked by Bloomberg.

The Czech reserve pile, which central bankers in Prague themselves have described as “enormous,” is a legacy of its Swiss-style currency cap from the last decade, when policy makers tried to keep the koruna weak by selling the local currency on the market.

Policy maker Tomas Holub said earlier this week that the bank is now more sensitive to koruna moves, because of fast consumer price growth and the inflationary impact of the depreciating currency.

(Updates with zloty, koruna reaction, background.)

©2022 Bloomberg L.P.