Mar 10, 2022

Deutsche Bank Sees $9 Billion in Payouts After Lifting Targets

, Bloomberg News

(Bloomberg) -- Deutsche Bank AG’s Christian Sewing vowed to raise profitability and flagged 8 billion euros ($8.8 billion) in potential capital distributions as he seeks to attract shareholders following his turnaround of Germany’s largest lender.

The chief executive officer is targeting a return on equity of more than 10% by 2025, up from 8% this year, along with annual revenue growth of around 4%. The new targets unveiled Thursday in Frankfurt also include a commitment to pay out half of the bank’s net income to investors in four years’ time.

Sewing’s strategy update comes three years after he embarked on an extensive restructuring to end a crisis of confidence in the bank’s business model. He cut thousands of jobs and quit equities trading, while a market rally fueled a rebound in revenue. But Russia’s invasion of Ukraine has abruptly stopped the nascent recovery for Europe’s banks, by saddling them with souring loans and delaying a much-anticipated increase in interest rates.

Key targets for 2025

- Post-tax RoTE of more than 10% by 2025

- Compound annual revenue growth of 3.5%-4.5% from 2021

- Implied net revenues of EU30 billion by 2025

- Cost-income ratio below 62.5%

- CET1 ratio of about 13%

- If successful, bank sees ~EU8 billion capital distributions for financial years 2021-2025

- Intention to reach total payout ratio of 50% from 2025

“Our strategy is now about shifting to sustainable growth and increased distributions to shareholders,” Sewing said in a statement. While the bank warned that the impact of the war can’t yet be fully assessed, the first two months of the year showed improvements in key metrics.

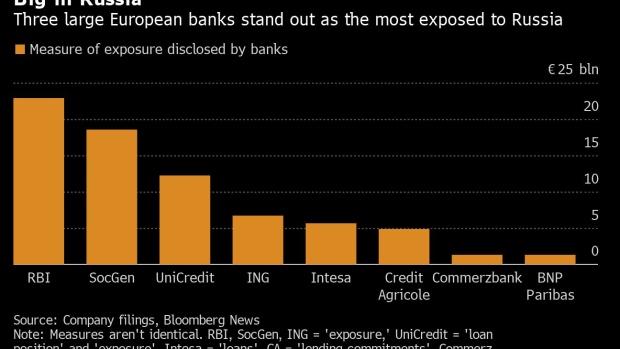

Deutsche Bank said late Wednesday that it’s net loan exposure to Russia was comparatively small at 600 million euros ($665 million) at the end of last year. At the same time, it’s closely monitoring other risks, including the impact of a potential shutdown of its information-technology hub in the country.

The bank on Thursday again confirmed its goal to reach a return of 8% on tangible equity this year. The metric already stood at 11.8% in the first two months.

“We have had a good start to the year across our businesses,” Chief Financial Officer James von Moltke said in the statement. “While the war in Ukraine creates increased uncertainty in the market environment, our exposures to Russia are contained and well controlled.”

Credit Suisse Group AG also on Thursday said that the war has led to an increase in trading and hedging, though that’s being offset by a drop in capital market issuances and higher credit provisions.

Before the invasion turned the banking sector on its head, several firms had started to outline plans for higher profit and shareholder returns, with Italy’s UniCredit SpA and France’s BNP Paribas SA leading the pack. That’s raised the bar for Sewing as he seeks to wow investors following his initial turnaround.

©2022 Bloomberg L.P.