Nov 17, 2022

Dollar Has Room to Strengthen in Bumpy Ride Ahead, Goldman Says

, Bloomberg News

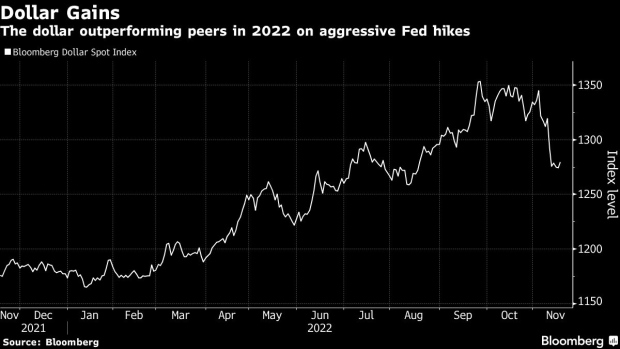

(Bloomberg) -- Goldman Sachs Inc. strategists said the US dollar will continue its ascent, though investors can expect to spend the next year navigating a tight rope between inflation and higher rates.

The dollar “still has a lot going for it” as the economy and labor market show resilience, while other central banks are struggling to keep up with the pace of the US Federal Reserve’s rate hikes, according to Goldman Sachs strategists Dominic Wilson, Kamakshya Trivedi and Vickie Chang.

“Expect a move higher in the dollar from here to be choppy and lower-quality than this past year,” they wrote in research note Thursday, pointing to how vulnerable the market remains to bad growth and inflation data.

Fed officials have been making hawkish statements even after four jumbo-sized rate increases drove a gauge of dollar strength up by 9% this year. Meanhile, the war in Ukraine has fueled a surge in energy prices putting Europe on the verge of a recession, and making it harder for other policy makers to boost borrowing costs.

The bank still expects the US to avoid an outright recession, estimating a probability of a downturn at about 35% in the next 12 months, but concerns about recessions elsewhere and risks to financial stability are also spurring the dollar higher and boosting its safe heaven appeal. There is a room for the dollar to extend “roughly another 3% on a trade-weighted index basis,” they wrote.

Past peaks in the dollar have come with lows in activity, strength in equity markets and easing monetary policy by the Fed, a set up Goldman said may take several quarters to materialize.

Earlier Thursday, Federal Reserve Bank of St. Louis President James Bullard said that 5% to 5.25% was the “minimum” policy makers should boost the rates from the current range of 3.75% to 4%.

China exiting its zero-Covid policies sooner than expected or a surprise easing in the Russia-Ukraine war could push the dollar to turn earlier, according to Goldman.

©2022 Bloomberg L.P.