Jan 12, 2023

ECB Long-Term Loan Repayments From Banks Seen Slowing This Month

, Bloomberg News

(Bloomberg) -- Euro-zone banks are expected to return less cheap long-term funding to the European Central Bank this month compared with at their last two opportunities, according to economists.

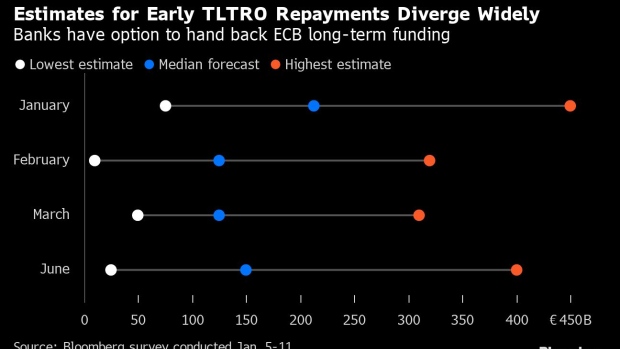

The median estimate among the eight respondents in a Bloomberg survey was for early repayments of €213 billion ($229 billion), with a range between €75 billion and €450 billion. The ECB will announce the number on Jan. 13.

Banks had already handed back more than €700 billion in November and December after ECB officials decided to toughen the terms of the loans, known as TLTROs. The financing helped during the pandemic to keep credit flowing to businesses and households.

The ECB has said changing the terms boosts its fight against inflation, during which borrowing costs have been lifted at the fastest pace in the central bank’s history. Declining TLTROs add to efforts to shrink the ECB’s balance sheet.

“These have dropped already quite a bit,” Chief Economist Philip Lane told a panel discussion last week. The sharp decrease from more than €2 trillion in outstanding long-term lending “has been relevant and will be relevant this spring,” he said.

The ECB also decided to gradually reduce its stash of bond holdings, starting with a monthly reduction of €15 billion from March.

Economists expect early repayments of long-term loans to fall further after this week’s round. More than €600 billion, or a little less than half of what’s currently outstanding, will come due in June.

©2023 Bloomberg L.P.