Dec 20, 2022

Economist Who Foresaw Housing Crunch Sees Home Prices Dropping

, Bloomberg News

(Bloomberg) -- An economist who foresaw the popping of the housing bubble more than 15 years ago expects US home prices to fall between 8% and 12% over the next two years as rising rates cut into pandemic-era demand.

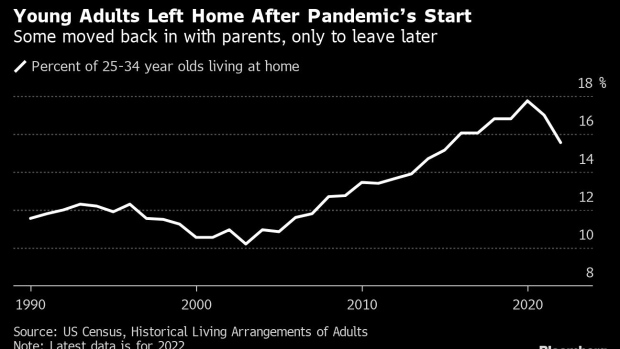

Tom Lawler, a former economist for Fannie Mae, sees demand falling in part because a shrinking number of people are moving out on their own and forming households. That’s in part because during the early part of the pandemic in 2020, many people under the age of 34 moved back in with their parents, or didn’t leave the home they grew up in.

Then in 2021, more younger people moved out on their own, contributing to the creation of about 2 million new households over the 12 months ended in March 2022, Lawler said, based on data in the Census’s Current Population Survey Annual Social and Economic Supplement. Over that period, the share of one-person households rose to the highest since at least 1990 while average household size fell to its lowest, 2.5 people per household.

But in the coming year, the rate of new household growth could fall in half, Lawler said, because so many people who wanted to move out of their current homes already have. His baseline case is for a mild recession.

“It’s reasonable that household growth or formation would no longer be goosed by these pandemic trends, and instead we’ll see household growth revert back to general trends in the population,” Lawler said. “And if that’s the case, then the slowdown in housing growth has already begun.”

Rising Rates

On top of household formation slowing, interest rates have risen dramatically this year, lifting mortgage rates at one point to their highest level in two decades, which increases ownership expenses for most buyers.

“If a lot of the special factors that you’re talking about fade away, at least partly, then as you had a two-year explosion in prices you could see a period where home prices either stagnate or more likely fall for a couple of years,” Lawler said.

Another reason to expect home prices to fall next year: new listings of homes, which have recently slowed to a dribble, will eventually pick up again, helping to increase supply. Lawler said that effect will probably be overshadowed by the return to long-run trends in household formation.

Lawler, who spent 22 years at Fannie Mae, earned a reputation for spotting risk after he foresaw the housing bubble that would go on to cause the 2008-09 financial crisis. The housing bubble may have begun as early as 2002, he has said, after the collapse of the tech-stock bubble led investors to search for alternative assets.

‘It’s Actually Good’

Lawler isn’t alone in expecting lower prices — Mark Zandi, chief economist for Moody’s Analytics, expects a nearly 10% downturn over the next two years from a peak in June.

But many other economists see less dramatic changes ahead. A survey of economists by Bloomberg Opinion columnist Alexis Leondis found that most are expecting average prices to stay within 5% of today’s levels in 2023. A team at Morgan Stanley team not long ago even predicted an increase in house prices of 3% next year.

Prices have already started dropping nationally. Median prices on existing homes were about $379,100 in October, down 8.4% from a peak of $413,800 in June, according to the National Association of Realtors.

To the extent that home prices drop, it’s cause for celebration, not moaning, Lawler said. Lower prices will make it easier for first time buyers to purchase, for example.

“It’s actually good,” Lawler said. “I think it would be good if affordability got better.”

©2022 Bloomberg L.P.