Jan 16, 2023

Egypt Hails $925 Million Inflows as Sign Devaluation Is Working

, Bloomberg News

(Bloomberg) -- Egypt saw more than $925 million in foreign-exchange inflows since Jan. 11, the central bank said, spotlighting what it called a series of “positive indicators” in the wake of the North African nation’s third devaluation in a year.

After the latest major move for the pound mid-last week, interbank trading activity was more than 20 times the recent daily average, the central bank said Monday in a statement. That enabled Egypt, which has been grappling with a foreign-exchange drought, to cover over $2 billion of importers’ needs in the past three days, according to the regulator.

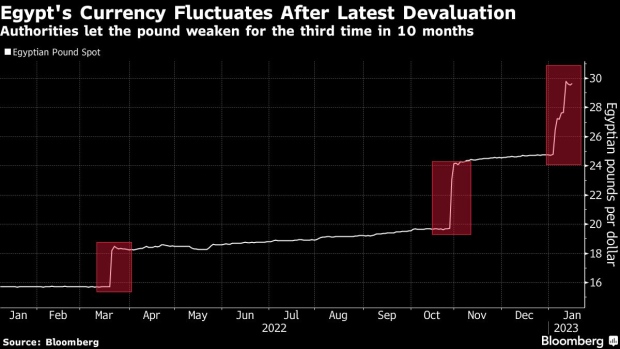

The currency has plunged more than 16% in 2023, after a pledge by authorities to allow greater flexibility in the exchange rate that was key to securing $3 billion in International Monetary Fund assistance. The Middle East’s most populous country had already devalued the pound in March and late October as part of efforts to buoy an economy heavily exposed to the shockwaves of Russian’s invasion of Ukraine.

The pound fell 0.3% to 29.6 per dollar on Monday, halting a two-day gain. The currency slumped to a record low of 32.1 last week, narrowing its gap with the rate on a black market that emerged as Egyptians struggled to find dollars through official channels.

The pound is the world’s worst performing currency this year, and measures of short-term historical volatility show the swings are the most extreme globally. The series of devaluations is also taking its toll on annual inflation, which hit a five-year high in December and piled more pressure on consumers in the country of over 104 million people.

The central bank also said:

- Net international reserves rose despite repayment of $2.5 billion in debt in November and December combined

- Current reserves cover 5.4 months of imports

- Banks are marketing currency derivatives to enable hedging against exchange-rate volatility

--With assistance from Netty Ismail and Tarek El-Tablawy.

©2023 Bloomberg L.P.