Oct 18, 2023

El Nino Is Set to Put an End to Peru's Long Run of Fruit Export Growth

, Bloomberg News

(Bloomberg) -- Peru’s agricultural exporters are bracing for tough times as a second year of bad weather upends a prolonged period of growth that turned the Andean nation into a fruit and vegetable powerhouse.

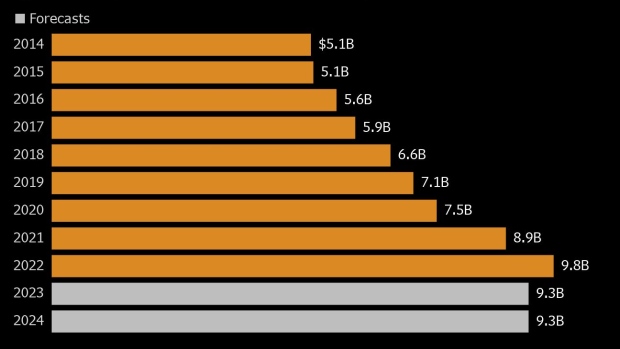

The El Nino weather phenomenon means revenue from farm shipments probably will shrink 5% this year and stay flat next year, said Gabriel Amaro, head of agribusiness group AGAP.

That’s a trend breaker in an industry that grew through the depths of the pandemic and when El Nino last struck in 2017. The uninterrupted expansion made Peru the top exporter of grapes and blueberries and among the biggest suppliers of mangoes, asparagus and avocados.

“These changes in climate have affected all of our production,” Amaro said in an interview. “We hope next year it won’t be too strong and we can at least have the same exports that we are generating this year. What we certainly won’t have anymore is the 10% annual growth rates that we used to have.”

Amaro said all of Peru’s big export items are expected to be hit hard. Piura in the north is of particular concern given the area is usually among the most affected by El Nino rains.

Read More: Violent Chaos Costs $300 Million in Peruvian Farm Shipments

AGAP was hoping to reach a record of almost $11 billion this year, but a double whammy of protests that blocked roads in the middle of the summer harvest and bad weather have eroded the outlook.

So far this year, agricultural exports are down 3%, with the negative impacts of El Nino expected to grow toward year-end, Amaro said. “In 2024, everything will depend on El Nino’s magnitude.”

A Peruvian state agency tasked with studying El Nino has said it’s most likely to be of “moderate” intensity, although the probability of a “strong” El Nino has grown. Ocean temperatures remain significantly higher than normal. That triggers evaporation that leads to downpours.

Amaro said the industry will finally know the size of El Nino in a couple of weeks, when the rainy season is expected to begin. “It’s very likely that it will not be more than moderate, but moderate causes problems.”

©2023 Bloomberg L.P.