Jan 4, 2024

Electric Vehicles Flatline in UK as Carmakers Ask for Tax Cut

, Bloomberg News

(Bloomberg) -- Electric vehicles’ market share growth has stalled in the UK, leading automakers now subject to a government mandate to seek a tax cut for consumers.

Roughly one in six new cars registered last year was battery-electric, in line with the year before, the Society of Motor Manufacturers and Traders said Friday. The trade group — whose members include Jaguar Land Rover, Nissan Motor Co. and BMW AG — is calling for the government to halve the value-added tax on EVs to 10% for a limited period.

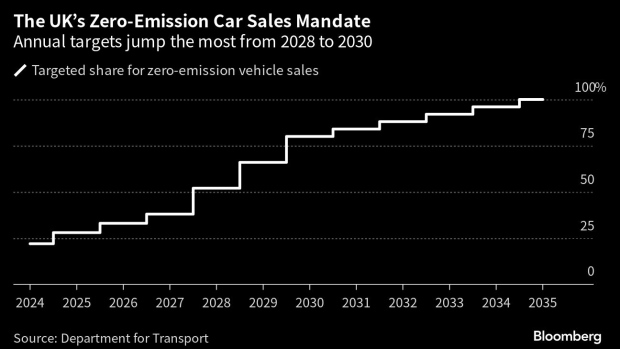

Reducing VAT for three years would save consumers about £7.7 billion ($9.8 billion) and put 270,000 more EVs on the road, the SMMT estimates. It also would boost automakers’ ability to meet the UK’s new mandate, which calls for 22% of each manufacturer’s sales this year to be zero-emission. The share requirement ratchets up annually to 80% in 2030.

“A mandate can compel supply. It can’t compel demand,” SMMT Chief Executive Mike Hawes told reporters. “For demand to meet those expectations, we do need to look at incentives” for the private consumer.

Read More: UK Gives Carmakers Flexibility to Meet Sunak’s EV Target

While the UK is the second-largest market for EVs in Europe, their share of the market is higher in countries including Germany and France. The UK is the only major country in Europe that no longer offers EV purchase incentives, after the government ended a plug-in car grant in June 2022.

The UK finalized its zero-emission vehicle mandate days after Prime Minister Rishi Sunak said in September that his government would ease the transition to EVs by allowing Britons to still buy petrol and diesel cars until 2035.

“I don’t think that the overarching message was particularly helpful,” Hawes said Thursday. “The messaging is differing from what the regulation is that affects the manufacturers.”

Overall new-car registrations jumped 18% last year to 1.9 million, which was still 18% below pre-pandemic levels. Growth was driven entirely by businesses and fleet buyers.

Businesses and fleet buyers also dominate the battery-electric segment, in large part due to compelling tax incentives. By contrast, only one in 11 private consumers are buying EVs.

Electric vehicles stumbled as 2023 came to a close, with sales plunging 34% in December, driven mainly by an anomalous showing from Tesla Inc. a year ago.

Tesla’s registrations of Model Y sport utility vehicles — its top-seller globally — rose 1% last year, while sales of the Model 3 plunged 29%, dropping the sedan to fourth place among all EVs.

The SMMT has forecast sales will rise about 4% this year to 1.97 million.

Read More: Leasing EVs Through Employers Unlocks Affordability in UK

(Updates with finalized registration figures after the second chart.)

©2024 Bloomberg L.P.