Jan 6, 2023

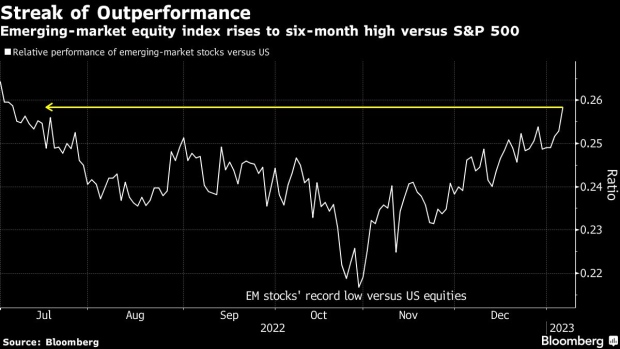

Emerging-Market Stocks Rise to Six-Month High Versus S&P 500

, Bloomberg News

(Bloomberg) -- Emerging-market stocks extended their lead over US shares in the early days of the new year, with the equity benchmark rising to a six-month high against the S&P 500 Index.

The MSCI Emerging Markets Index has advanced 3% this week, compared with a 0.8% decline in the US gauge, continuing a turnaround that began in recent months following its worst annual losses since the 2008 global financial crisis. China’s reopening, a softer dollar, and signs of easing global inflation have been spurring gains, leading the gauge to rise Friday for a fourth day to its highest since August.

Its rally mean developing-nation shares have handed investors an excess return of almost 19% over their New York-listed peers since late October. Options traders are betting this gap will widen, and cutting their expectations for volatility in emerging markets, while raising them for the US.

“There is increasing evidence that the outperformance of the broad EM index versus the S&P 500 could continue, as we face a peak in US rates, a weaker dollar and a counter-cyclical recovery in China, which should ultimately benefit the emerging markets outside Asia,” Nenad Dinic, an equities analyst at Bank Julius Baer in Zurich, said.

EM stocks have been struggling for a half-decade, and in 2022 they fell to their lowest level since 1988 relative to their US peers. Dragging them down were a succession of risks faced by their economies, from the US trade war with China, to the onset of the pandemic and then Russia’s invasion of Ukraine and a pivot to a rate-hiking path by the Federal Reserve. China’s Covid lockdowns added to the pressure on the asset class.

But China’s dismantling of Covid restrictions has led to a rebound in consumer confidence and benefited commodity exporters like South Africa with close ties to the world’s second-largest economy. Inflation is also easing in nations from Brazil to India, while the potential that the Fed will slow its rate-hiking trajectory is bringing capital flows back into emerging markets.

Riskier assets like emerging market stocks have also regained favor as the dollar softened: A gauge of the greenback’s strength has slid almost 7% from a record high reached in September, ending a 21-month rally in the haven asset.

“Valuations have been depressed for a long time and they were due for a correction but the real catalyst for the outperformance was the dollar weakening and China coming back online,” said Aneeka Gupta, a director at Wisdomtree UK Ltd. in London. “Intra emerging-market trade will improve if China improves.”

A rebound in their economies from Covid is also sparking inflows into developing markets, as the growth differential between them and rich countries widens.

The gains in emerging markets come as volatility also eases. A 100-day rolling measure of swings in the MSCI Emerging Markets Index trades at 20%, four percentage points below that of the S&P 500. The CBOE Emerging Markets ETF Volatility Index, based on options, fell this week, while the VIX gauge rose.

Cheaper valuations are luring investors back to emerging markets. The MSCI index traded at a discount of almost 40% to the S&P 500 in October, based on forward-looking price-earnings ratios. The rally since then has reduced that discount, taking it to 28% after this week’s gains. That’s the narrowest gap since March 2021.

©2023 Bloomberg L.P.