May 3, 2023

Energy Crisis Prompts Thailand to Accelerate Shift to Renewables

, Bloomberg News

(Bloomberg) -- The fallout from the global energy crisis is pushing Thailand to accelerate its shift to renewables after dragging its feet for years, the latest nation to embrace wind and solar in order to reduce dependence on imported fuel.

The Southeast Asian country was forced to rethink its renewable energy strategy following last year’s surge in natural gas prices sparked by Russia’s invasion of Ukraine, said Wattanapong Kurovat, director-general of the Energy Policy and Planning Office. The situation was exacerbated by Thailand’s drop in production.

“When we called on renewables plants to sell us more energy last year, we found that what we had was really all there was,” Wattanapong said in an interview in Bangkok. “We couldn’t call for more when we needed it.”

While some nations are responding to the surge in global fuel prices by investing more in coal mines or gas fields, others — like Thailand — are looking at solar panels and wind turbines to make themselves more energy independent.

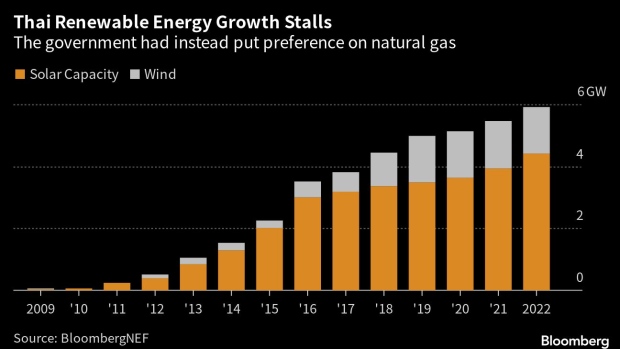

As part of an energy security push, the government last month announced winners for a roughly 5-gigawatt renewables power purchase plan — the nation’s biggest so-called feed-in tariff program — that is set to essentially double its wind and solar capacity by 2030. On top of that, authorities are now also planning another round for 3.67 gigawatts later this year, said Wattanapong.

This is a reversal for Thailand, which had stalled new wind and solar in preference for natural gas for years as a transition fuel to eventually adopt cleaner sources. It can also be difficult in parts of the emerging world for renewable projects to gain a foothold amid grid restraints, red-tape and a lack of funding.

Thailand depends on liquefied natural gas imports for its power generation, resulting in sky-high costs after spot prices surged last year. The nation’s state power utility was saddled with roughly 150 billion baht ($4.4 billion) in costs to curb utility bill hikes last year.

Rising power costs have become an issue as Thailand’s election campaigns heat up ahead of a May 14 vote, prompting several political parties to propose cutting energy bills. As households and businesses suffer, the groundwork for domestic renewable sources has become more urgent, Wattanapong said.

The government’s next power development plan, which is expected to be unveiled and proposed later this year to a new cabinet after this month’s general election, is going to have more ambitious renewable energy goals, said Wattanapong. The revisions are also aimed at helping Thailand reach its climate goals to cut emissions 30%-40% by 2030, on a path to reach net zero by 2065.

Renewables will account for more than 50% of the power generation mix by 2037, up from about 20% in the current plan, said Wattanapong.

The urgency is also punctuated by declining domestic gas production. Output at Erawan, Thailand’s biggest natural gas field, plummeted by 64% last year after US energy major Chevron Corp. handed over the field to state-owned oil and gas firm PTT Exploration & Production Pcl. While it aims to lift domestic output through 2024, the government wants to cede dependence on the fuel.

“Our domestic natural gas is only going to keep depleting,” said Wattanapong. “Eventually, gas will play an ever smaller role in the power mix.”

--With assistance from Ann Koh.

©2023 Bloomberg L.P.