Jan 29, 2023

ESG Manager With $46 Billion Eyes New Options on US Climate Bill

, Bloomberg News

(Bloomberg) -- Impax Asset Management Group Plc, one of the world’s largest ESG fund managers, is exploring stocks and sectors it once avoided as the US Inflation Reduction Act redraws the green investing map.

The IRA, which promises to inject at least $369 billion into clean energy, is a game changer for the future of ESG investing, said David Winborne, a senior portfolio manager at Impax in London. Until now, the returns on renewable assets had tended to look unappealing because of the fragmented nature of the industry, but “we have a sense that’s starting to turn because it’s now a more consolidated industry with potentially more pricing discipline emerging,” he said in an interview.Half a year after it was signed into law by President Joe Biden, markets are still analyzing the IRA’s impact on green assets and the supply chains that feed them. Its political fallout is also still playing out. The European Union, which suddenly finds itself on the back foot after long accusing the US of lagging behind in green initiatives, is trying to figure out a coordinated response to what it has characterized as protectionism. The European Union is discussing how to counter the US green subsidy package and tackle the challenge of ending its dependence on Russian energy and rebuilding Ukraine. Options range from simply reshuffling existing funds and bolstering the European Investment Bank to additional joint borrowing to create new tools and topping up its common budget.

Speaking to workers in Virginia, Biden suggested Thursday that the IRA’s green incentives will help other countries, and predicted that democratic nations will ultimately “benefit from what we’re doing.” But he also said he intends to make sure that supply chains “end with us.”

Read More: Biden Dismisses Foreign Gripes About Policy: ‘To Hell With That’

Green investors, meanwhile, are looking for the best way to get maximum exposure to companies at the receiving end of subsidies.

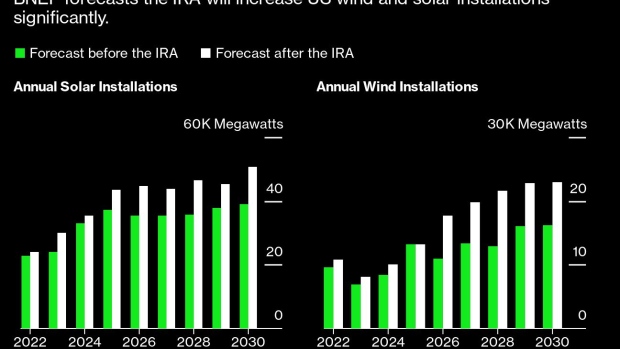

Impax, which oversees about $46 billion in client funds, is now reviewing its energy portfolio, as sectors previously hobbled by uncertainty become attractive. The firm estimates that clean electricity alone is set to get a $120 billion IRA boost in the form of tax incentives, which Winborne says makes wind power more appealing.

“It provides an additional tailwind and accelerates a lot of trends in clean energy,” he said, declining to identify individual stocks.

Another big IRA beneficiary is the electric-vehicle industry, which Impax estimates will make up 15% of global vehicle production by the end of the year helped by the law. But Impax is more interested in supply chains than the finished product.

“We don’t know which car company will dominate,” Winborne said. “But demand for EV components will go up regardless.”

Impax also has started to take an interest in companies that work in clean hydrogen or on technologies that cut emissions for heavy-duty trucks and shipping, which are more appealing after the IRA, Winborne said. Such areas “could be quite interesting,” he said. But “some of the earlier stage stuff like sustainable-aviation fuel isn’t an area of investment for us now.”

Though the law was signed back in August, investors are still calculating its scope and reach. Goldman Sachs Group Inc. analysts said late last year that it will take a while for the market to grasp the full impact of the IRA, especially its potential to change investment dynamics up and down the supply chain.

Read More: EU Needs Way to Compete With US, China on Clean Energy, IEA Says

The law offers about $260 billion in tax credits, as well as grants, loans and supporting policies for mature sectors such as solar, wind and nuclear power. New technologies such as hydrogen and carbon capture also stand to get a boost.

For now, investors may be assuming that the IRA favors US companies. That calculus might shift as the European Commission explores the potential relaxation of limits on national subsidies to help the bloc compete with the IRA. Additionally, the US and EU are in talks to look at giving European companies access to parts of the IRA.

The coming months will show whether Europe's green agenda can co-exist with the IRA, or “be a direct rival to it,” analysts at Barclays Plc said in a client note. The response from India and China will also be key, especially when it comes to incentives around solar, they said.

“At first glance, IRA is clearly favorable to American companies or international companies running business locally in the US,” said Hua Cheng, a money manager at Mirova SA, the $29 billion sustainable-investing unit of Natixis SA. “However, it may also depend on the reactions of other countries over the long term and the consequence may become less clear partially due to fierce competition.”

Fund managers have different views on which part of the green economy will benefit most. Clean-energy technologies also tend to be long-duration assets, making it hard to assess risk-return dynamics. And the sector is heavily dependent on commodities, such as the lithium used in EV batteries, whose values can be volatile.

Winborne said an area often neglected by green investors is buildings and energy efficiency. IRA offers $9 billion in rebates for retrofitting homes with energy-efficient measures like heat-pump installation and insulation, which adds to the appeal of US equipment rental companies that supply tools, scaffolding, lighting and generators for infrastructure projects, he said.

“With the IRA, companies are moving fast to respond,” Winborne said. “We think it’s an interesting secular growth opportunity.”

--With assistance from Saijel Kishan.

(Updates fourth paragraph on EU discussions to counter US green subsidies)

©2023 Bloomberg L.P.