Nov 9, 2023

ESG Veteran Says Purge Has Further to Go With ETFs Next in Line

, Bloomberg News

(Bloomberg) -- The bad year that a lot of ESG investors are having may be about to get even worse.

According to James Penny, the chief investment officer of TAM Asset Management and a veteran of ESG investing, the dramatic selloff that’s torn through green stocks may soon morph into a “slow burn” that could last several more years.

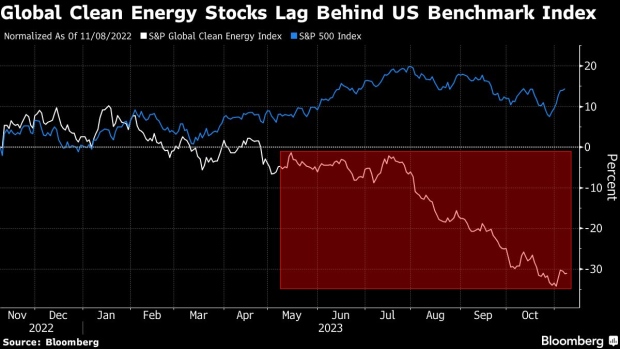

The green correction — with the S&P Global Clean Energy Index down more than 30% over the past year — has “definitely shaken some investors within ESG impact sustainability,” Penny said in an interview. It’s “definitely been a tough time to be invested in thematics in sustainability.”

This was supposed to be the year that investors targeting environmental and social goals would see their assets buoyed by historic support packages, such as the US Inflation Reduction Act. Instead, decades-high inflation and soaring interest rates ended up hammering a lot of traditional ESG stocks, with wind and solar standing out as some of the biggest losers.

For investors, the main risk now lies in sticking with the kinds of passive green strategies that exchange-traded funds offer, Penny said.

The situation to avoid in a “slow burn” is getting stuck with companies “that consistently are under pressure,” he said. There will be companies that “just can’t survive” and there also will be some that will outperform, he said.

“You don’t want to own thematic ETFs that own the whole market in that space,” Penny said. “Active management is key.”

ESG investing has struggled to regain its footing since the pandemic, when lockdowns drove down energy prices and buoyed portfolios that shunned fossil fuels. But when those lockdowns ended and economic activity came roaring back, the world order that followed proved poisonous for many ESG strategies.

A lot of ESG companies are capital intensive, which makes them more vulnerable to higher borrowing costs than oil and gas companies with well-established rigs and platforms. To make matters worse, wind and solar producers have been hit by project delays exacerbated by supply-chain bottlenecks.

The best-performing ESG funds are packed full of tech stocks like Microsoft Corp. and Nvidia Corp., while some of this year’s worst-performing ESG strategies are overweight renewable energy stocks such as Siemens Energy AG and Orsted A/S. Both companies have lost roughly half their market value this year.

Though ESG fund flows have cooled overall, ESG ETFs have continued to draw in more new money than their non-ESG counterparts. Last quarter, ESG ETFs saw a 6.6% increase in flows from the previous three-month period, compared with a 3.5% declined in non-ESG ETFs, according to data compiled by Bloomberg. In the year through September, ESG ETF flows almost doubled, compared with a 20% increase in non-ESG ETFs, the data show.

Penny, who last year correctly predicted the downturn that’s since engulfed green stocks, says a key vulnerability for ESG investors is the lack of US investor commitment to the strategy.

“The US market is by far and away the biggest thing in the stock market,” and as long as the US continues to treat green investing with limited interest, “you won’t see that massive client pick up,” Penny said.

Against that backdrop, “active management I think is going to be critical, really critical, in picking out the winners of tomorrow,” he said.

What Bloomberg Intelligence Says:

ESG ETF assets in the Americas might continue to lose share globally after reaching $111 billion in 3Q, or 21% of worldwide ESG assets amid concentration risks, vs. 27% in 2020. US political backlash may prolong a slowdown this year by muting investor expansion, but we don’t think this caused slower flows in 2022. Assets are fairly concentrated among large managers, creating fee pressure and competition.

Click here for the full report by BI’s Shaheen Contractor.

A few years back, ESG was attracting investors who were there not just because they wanted to do good, but because they thought the strategy would deliver outsize returns, Penny said. A lot of those investors have since walked away, which may not be a bad thing, he said.

For ESG fund managers, “it’s probably quite a good thing that they’ve washed out all of the hot money and it’s just left with their dedicated capital,” according to Penny.

There’s still plenty of money to be made using ESG as an investment strategy, but only if that strategy is active, Penny said. That could also include actively looking for green stocks that have fallen far enough to become potential acquisition targets.

A wave of green mergers and acquisitions is now “very, very likely,” Penny said.

“There are going to be some companies out there that are struggling” but that also have “great intellectual property, great ideas and great disruptive trends,” he said. “You’re going to see a lot of M&A in that sector.”

--With assistance from Akiko Itano.

(Adds BI comment.)

©2023 Bloomberg L.P.