May 26, 2022

Ether and Altcoins Lead Crypto Rout as Terra DeFi Fallout Deepens

, Bloomberg News

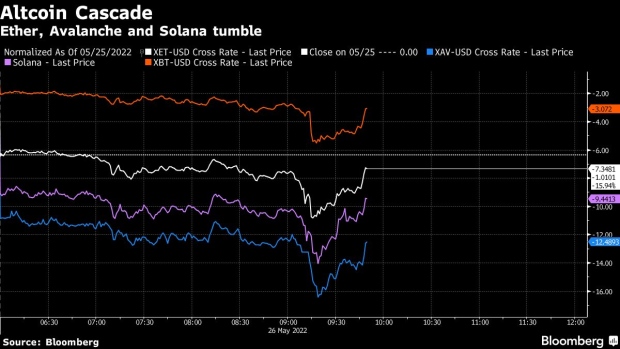

(Bloomberg) -- It’s an all-round sea of red for nearly everything in crypto on Thursday, with altcoins such as Ether, Solana and Avalanche take a beating. Traders are partially stumped as to why this is happening today in particular, but for Ethereum, the signs of a lack of demand have been building for quite some time.

The impact of the collapse of Terra, a blockchain ecosystem that supported one of the biggest experiments in decentralized finance, knocked an already bearish market into wild contagion this month. While Terra’s operators had passed a revival plan to start afresh on a totally new blockchain on Wednesday, investors in the rest of DeFi were less than convinced.

Ether was down as much as 11% on Thursday before paring losses to around $1,806, far below the key threshold of $2,000 which it needs to trade above meaningfully -- and soon -- if bearish sentiment is to ease. Other tokens linked to protocols popular with decentralized finance projects like Avalanche, Solana and Polkadot were also slumping, down between 11% and 17% over the last 24 hours.

Bitcoin acted as somewhat of a haven, paring losses to around 3% after dropping to as low as $28,007.

Demand for blockspace on the Ethereum network has reduced significantly in the wake of Terra’s collapse, which means that consequently, the network’s exorbitant gas fees are falling. With the exception of a few spikes during high-profile minting events like Yuga Labs’ Otherside land sale, Glassnode data show gas prices have been trending downward since December and recently reached multi-year lows.

Coupled with poor price performance, that’s likely to exacerbate headwinds for the token in the short term. DeFi developers are dusting themselves off after Terra’s collapse halved the sector’s total value, and dampened markets aren’t going to help in convincing them that now’s the time to get back in the game.

Investors who once were hot on crypto have cooled on its prospects as the Federal Reserve’s rate-hiking regime spurs volatility in the market and dulls previously-hot growth and speculative assets. Guggenheim Partners Chief Investment Officer Scott Minerd said he expects Bitcoin to fall to $8,000. He had once predicted that it could reach $400,000.

©2022 Bloomberg L.P.