Apr 9, 2024

Euro-Zone Firms’ Loan Demand Fell ‘Substantially,’ ECB Says

, Bloomberg News

(Bloomberg) -- Demand for corporate loans in the euro area saw a “substantial decline” in the first quarter as the region continues to reel from elevated borrowing costs that probably won’t be cut until the middle of the year, the European Central Bank said.

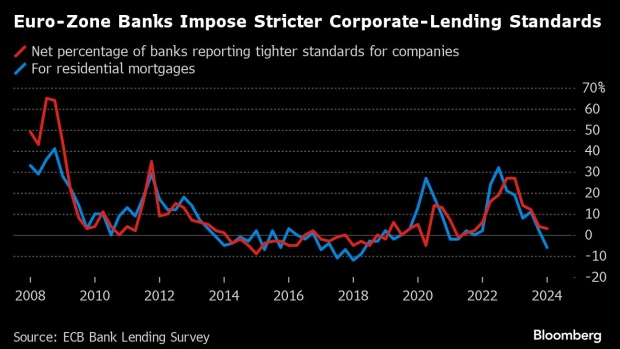

The ECB’s quarterly Bank Lending Survey, published Tuesday, also showed that credit standards — banks’ internal guidelines or loan-approval criteria — were a little tighter for firms across the 20-nation bloc. There was a moderate easing for mortgages for the first time since late 2021.

“Higher interest rates, as well as lower fixed investment for firms and lower consumer confidence for households, exerted dampening pressure on loan demand,” the ECB said. “The substantial decline in loan demand from firms contrasted with banks’ prior expectations of a stabilization.”

A separate poll released Monday by the ECB showed companies reported a modest reduction in the need for loans in the first quarter, while fewer reported a reduction in their availability.

Officials in Frankfurt are parsing such data to determine how soon and how quickly they can undo their unprecedented series of interest-rate increases. With inflation in retreat, cuts are expected to begin in June. Analysts widely expect the deposit rate to be kept at a record-high 4% when policymakers meet this week.

“The weaker firm loan demand raises the risks of an investment slowdown later in the year,” said Tomasz Wieladek, chief European economist at T. Rowe Price. “This is a clear indicator that monetary policy remains too tight in the euro area.”

Despite just managing to escape a recession after Russia attacked Ukraine and consumer prices surged, the bloc has barely registered any growth in more than a year.

Banks continued to enjoy a “markedly positive” impact on their net interest margins over the past six months from the ECB’s rate hikes, though the cumulative effect is expected to diminish over the next half year.

While corporate loan demand may decrease further in the second quarter, according to Tuesday’s survey, it should pick up for households. Lenders expect moderately tighter credit standards for firms.

(Updates with economist comment in sixth paragraph.)

©2024 Bloomberg L.P.