Jan 6, 2023

Euro-Zone Inflation Slows Sharply With Hope That Peak Has Passed

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Euro-area inflation returned to single digits for the first time since August, fueling hopes that the bloc’s worst-ever spike in consumer prices has peaked.

December’s reading came in at 9.2%, Eurostat said Friday, with slower growth in energy costs the only reason for the moderation. The figure reflects slowdowns in Germany, France, Italy and Spain and was less than the 9.5% that economists polled by Bloomberg had expected.

Highlighting how inflation continues to menace Europe’s economy, however, a measure of underlying price pressures that strips out energy and food edged up to a record 5.2%.

It’s this gauge that the European Central Bank is likely to focus on as it pushes ahead with what’s already the most aggressive bout of interest-rate hikes in its history. In the US, the Federal Reserve, too, is looking past an easing in headline inflation, warning investors against underestimating its will to tighten monetary policy for some time yet.

ECB Governing Council member Mario Centeno called the latest price data from Europe “quite positive,” but said borrowing costs must still be pushed higher.

“Interest rates will rise until the moment when we consider that the inflation profile is sufficiently robust to as quickly as possible bring inflation to 2%,” he told a conference in Lisbon. “We can’t hesitate on the path. In our opinion, inflation is more negative for the economy than this process of normalizing interest rates.”

What Bloomberg Economics Says...

“The rise in the core reading will add to the Governing Council’s concerns about the persistence of inflation. If those stronger pressures are confirmed going into 2023, the hiking cycle is likely to continue in the second quarter.”

—Maeva Cousin, senior economist. Click here for full REACT

A second month of cooling price gains in the euro zone, which expanded to 20 countries from 19 this month as Croatia joined, came after Germany’s government paid some households’ natural gas bills to cushion the surge in costs since Russia invaded Ukraine.

Indeed, the drop in German consumer prices was almost solely responsible for the 0.3% monthly decline in the euro area, according to Bloomberg calculations.

The ECB has already pledged to lift its deposit rate beyond its current level of 2%. The peak for borrowing costs may only be reached toward the summer, according to Bank of France chief Francois Villeroy de Galhau.

“We’ll then be ready to remain at this terminal rate as long as necessary,” he said Thursday in Paris. “The sprint of rate increases in 2022 becomes more of a long-distance race, and the duration will count at least as much as the level.”

Latvia’s Martins Kazaks expects “significant” increases at the next two meetings, in February and March. Inflation in his homeland reached as high as 22% and remains near that now.

Money-market traders left bets on the peak in the deposit rate largely unchanged on Friday, wagering on about 152 basis points of additional tightening by mid-2023.

President Christine Lagarde has cautioned against focusing on changes in Europe’s headline rate, saying “we cannot be fixated on one single number,” as there are “good reasons to believe” price growth will pick up again in January.

In the short term, unseasonably warm weather has calmed fears of an energy crunch and brought gas prices down to pre-war levels. But with the euro region now only expected to experience a short and shallow recession, demand — and inflation, in turn — could hold up.

Separate figures Friday showed economic sentiment recovering for a second month in the euro area in December, while remaining below its long-term average.

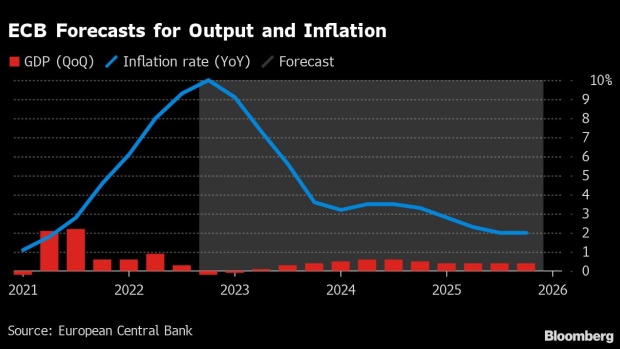

The latest ECB projections see price gains averaging 6.3% in 2023 and still remaining above the 2% target in 2025.

--With assistance from Joel Rinneby, Barbara Sladkowska, Craig Stirling, Anna Edwards, Mark Cudmore, Libby Cherry, Jana Randow and Joao Lima.

(Updates with Centeno starting in fifth paragraph.)

©2023 Bloomberg L.P.