Oct 28, 2022

Europe Can’t Rely on US Gas to Plug Growing Shortfall Next Year

, Bloomberg News

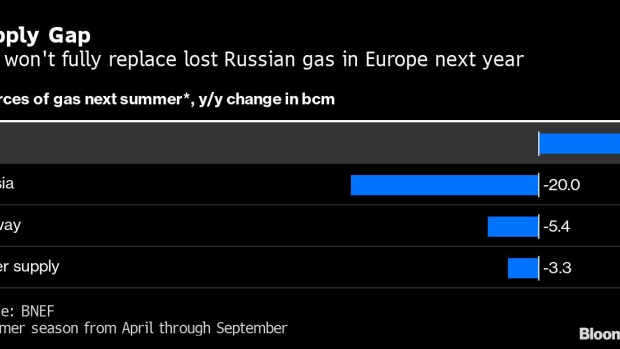

(Bloomberg) -- Europe has been able to plug the gap left by smaller Russian gas flows with US supplies, but those shipments won’t be able to keep up as the shortfall expands.

While US fuel now makes up 40% of Europe’s liquefied natural gas imports, it will only offset a fraction of the deficit from Russia next summer, BloombergNEF says. That means it’ll be harder to rebuild inventories next year when faced with a longer period without Russian gas.

Securing shipments not needed by top buyer Asia has been crucial for Europe as it swaps piped supplies for the super-chilled fuel. To meet demand going forward, it needs to remain an attractive market for sellers and pull about 70% of global spot supplies, primarily from the US, as LNG output growth remains limited in the next few years.

Since supply cuts from Russia -- once Europe’s top gas supplier -- didn’t come until late into the summer storage campaign, the lack of flows will be even more glaring next year. That will require more LNG, but also “persistent demand destruction,” BNEF said Thursday in a report.

“US supply is particularly price sensitive and will flow to the premium market, which Europe will remain unless Asian demand picks up,” BNEF analyst Arun Toora said. “However the year-on-year increase is not sufficient to offset a total cut in Russian piped supply with under half of these volumes met by LNG increases.”

LNG imports into northwest Europe and Italy between April and September will probably rise by 9 billion cubic meters from a year earlier, according to BNEF. But with key Nord Stream pipeline supply halted and the ongoing risk of a complete shutoff via Ukraine, the shortfall from Russia could reach 20 billion cubic meters.

One problem is that there’s a limit to US supplies. An outage at the Freeport project in Texas means American LNG exports will rise by a less-than-expected 12% this year, and increase by a similar rate in 2023, according to Bloomberg Intelligence.

Another issue is uncertainty over where that LNG will go. Energy majors and traders have secured most US exports and also largely locked in future American supplies, and can send them to where prices are highest. That means more may head to China if easing of Covid restrictions boosts demand there, rather than to Europe.

US Market

Europe’s purchases are helping the US to keep gas exports near maximum levels and to cap a widening trade deficit. But strong global demand is also causing historically high prices in America, adding to household energy bills and fueling inflation.

And in New England, there’s a risk of gas shortages this winter due to high US exports, the Federal Energy Regulatory Commission said.

America is now sending about 60% of its supply to Europe, double last year’s share, said Xi Nan, an analyst at Norwegian consultant Rystad Energy. US Secretary of State Antony Blinken said the US is working to further boost that trade after becoming the top LNG supplier to the European Union and UK this year.

How full Europe’s storage sites get next summer will be a direct consequence of the amount LNG Europe can pull from global markets. More than 43% of the fuel can go anywhere according to contracts, BNEF’s database shows.

Should the region import 60% of spot LNG, storage injection rates could stumble and reach just below 70% by the end of the summer, BNEF said in its monthly outlook. This year, they have reached 94% full.

US LNG exports - largely all destination-flexible - have grown steadily since starting in 2016 amid a shale-gas boom and have mainly gone to South America and Asia. That changed late last year when soaring prices in Europe prompted traders to divert cargoes -- sometimes mid-journey -- as the region weaned itself of Russian gas that it had been tied to for decades.

Still, the amount of extra LNG that could offset lost Russian flows to Europe may drop to 35% next summer from 42% this winter, BNEF says. Yet supplies -- mostly from the US -- should pick up with the next wave of projects starting in late 2024. Europe also needs to expand capacity to import LNG and ease infrastructure bottlenecks.

“The US will need to expand its LNG export capacity and the EU will need to expand its import capacity over the next several years,” Rystad Energy said in a study.

--With assistance from Ben Holland, Thomas Gualtieri and Elena Mazneva.

(Updates with BNEF outlook from fourth paragraph.)

©2022 Bloomberg L.P.