Dec 13, 2023

Europe Real Estate Facing €176 Billion Debt Refinance Shortfall

, Bloomberg News

(Bloomberg) -- A wall of real estate debt is coming due across Europe in the next four years and more than a quarter of it may not be refinanced, according to CBRE Group Inc.

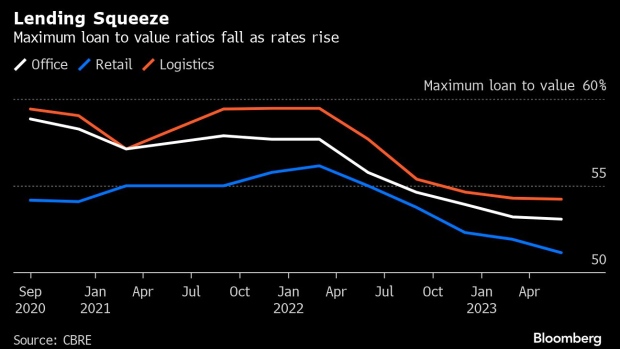

Between the estimated €640 billion ($690 billion) of loans provided in the years 2019 through 2022 and the amount now available to refinance them, there’s a gap of as much as €176 billion, an analysis by the broker showed. That’s because property values have shrunk and debt has become both scarce and more expensive, CBRE said in a report Wednesday that examined the scale of the potential shortfall in the years 2024 through 2027.

Banks have reined in lending in the face of plummeting asset values and a rise in the number of troubled property loans on their balance sheets. That’s compounding the already difficult environment for borrowers who have found their relative indebtedness rise as asset values fall. While some have been able to inject new equity to secure fresh loans, others are having to sell, if they can.

“European real estate markets have experienced a challenging period over the last two years,” the report’s authors including Tasos Vezyridis wrote. “Market conditions have been especially challenging for leveraged investors.”

Loans against office buildings account for almost half of the forecast shortfall, CBRE’s data show. The deficit for retail properties is smaller but as a percentage of the debt originated, high-street stores have the largest gap at 30%.

The forecast gap is based on current pricing and debt availability but that could narrow over the period if rates stabilize and central banks start to cut as currently expected. That would lead to some recovery in capital values and improved financing terms, reducing the gap by about 35%, according to CBRE’s analysis.

©2023 Bloomberg L.P.