Oct 31, 2022

Europe’s Firms Seek Out Most Emergency Funds Since Pandemic Peak

, Bloomberg News

(Bloomberg) -- Firms grappling with high inflation and soaring operating costs are seeking fresh short-term liquidity lines in an echo of the worst days of the 2020 coronavirus pandemic.

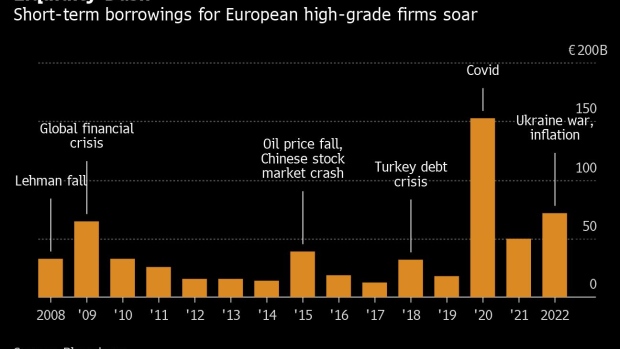

European high-grade companies are taking out facilities maturing in two years or less, significantly shorter than the average five-year term of conventional loans. They’ve sealed €76 billion ($75 billion) of short-term financing this year -- the second-highest on record after the €153 billion extended in 2020, according Bloomberg-compiled data.

The increase in emergency funding is a worrying sign as central banks fight to tame surging inflation. The European Central Bank last week doubled its key interest rate to the highest level in more than a decade, while the US Federal Reserve is expected to remain hawkish when it delivers its latest monetary policy decision on Thursday.

Deal flow is being driven by factors including rising commodity prices, margin calls, expectations of further volatility and pricing uncertainty, said Lucie Caresmel, head of EMEA corporate loan distribution with Credit Agricole Corporate & Investment Bank. She said companies were also borrowing “to get their general corporate purposes core financing in order.”

Shorter-term financing proved popular during the onset of the global pandemic, when global lockdowns shuttered most business activity. The loans allowed borrowers to shore up balance sheets amid much uncertainty about when economies would re-open.

As recently as last week, investment-grade rated Dutch medical equipment maker Koninklijke Philips NV got a €1 billion loan with a 12-month term “in light of recent developments and market volatility.” A spokesperson for the company said via email that the measures taken would “further strengthen our near-term liquidity position, as we expect a better cash flow from operating activities next year when we deliver on our strong equipment order book.”

Other firms that have sought short loans include Enel SpA, Daimler Truck AG and Swiss energy firm Axpo Holding AG. Borrowings from companies within the energy and utilities sector make up two-thirds of the full-year tally, while earlier in the year commodity traders rushed to raise such funds after Russia’s invasion of Ukraine sent prices soaring.

Bond market volatility has also pushed some firms toward taking out short-term loans to cover looming debt maturities, given the widespread uncertainty that’s swept global markets this year and at times shuttered the ability to bring a bond deal.

“It is important to underline the resilience of the syndicated loan market, which has remained open for borrowers, and which, so far, has not shown any signs of a liquidity shortage,” said Reinhard Haas, global head of syndicated finance at Commerzbank AG in an interview with Europe’s Loan Market Association.

Elsewhere in the credit markets:

EMEA

There’s just one deal so far in Europe’s primary bond market on Monday, as Germany government-guaranteed KfW offers a minimum €1 billion green bond.

- An abundance of events including central bank rate decisions, economic data and public holidays could hamper the week’s deal flow

- More than half of market participants in a Bloomberg News survey expect this week’s issuance to be at least €20 billion after previous weekly sales of €18 billion

- Non-financial corporate borrowers made up the majority of the issuance last week

- French embattled nursing home operator Orpea SA saw its debt losing as much as 80% of its face value

- Rising interest rates, inflation and recession risks have eroded consumer confidence and left buyout firms facing higher financing costs and potentially lower returns

Asia

Chinese dollar bonds are on pace for one of their weakest-ever months, with both high-yield and investment-grade notes sliding alongside the country’s currency and equities on continued economic uncertainty.

- Longfor Group Holdings Ltd’s dollar bonds slumped after the developer’s founder resigned as chairman

- On the domestic front, Shenzhen Municipality becomes the third Chinese local government in recent weeks to market CNH bonds

- Elsewhere, the South Korean government is pledging support to help ease burden on local credit market as borrowing costs soar

Americas

A seven-bank group providing about $13 billion of underwritten loans to Elon Musk to buy Twitter Inc. is now faced with a challenging task to syndicate the financing given the newly-purchased firm’s heavy debt load.

- Twitter’s buyout loan only exacerbated the pile of such debt sitting on banks’ balance sheets

- Goldman Sachs Group Inc.’s chief credit strategist Lotfi Karoui is also warning investors to watch out for pockets of weakness in leveraged loans and the lower end of the junk-bond market as the Federal Reserves hikes rates

- Meanwhile, Canada’s government is targeting individual investors with a new triple-A rated so-called Ukraine Sovereignty Bond of which proceeds will be on-lent to Ukraine at same interest rate

(Updates with global credit markets’ developments)

©2022 Bloomberg L.P.