Apr 2, 2024

European Banks Are On Longest Winning Streak Since Before Crisis

, Bloomberg News

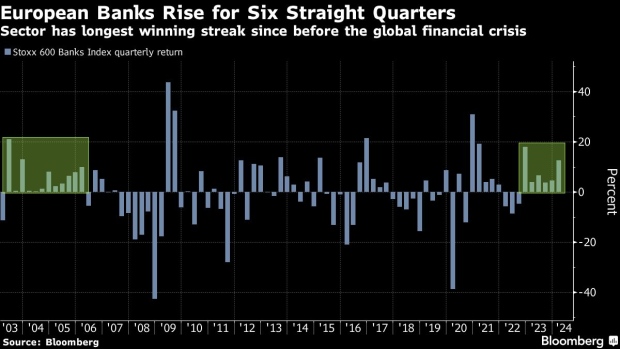

(Bloomberg) -- Higher interest rates have done wonders for European banking stocks, which are on their longest winning run since before the global financial crisis of 2008.

Europe’s Stoxx 600 Banks Index notched a 13% gain in the first quarter, and has risen for six straight quarters for the first time since 2006. Italian and Spanish lenders such as UniCredit SpA and Banco Bilbao Vizcaya Argentaria SA have led advances.

Higher dividends and buybacks, as well as increased earnings, have underpinned the sector, offsetting concerns over future rate cuts. And with forward price-to-earnings multiples still about 50% below those of the broader market, some investors say the rally has legs.

“We expect that the European banking sector will perform somewhat better than the market average in the coming months,” said Roberto Scholtes, head of strategy at Singular Bank. “We move from the phase of the cycle in which profits skyrocket due to the rise in interest rates to another in which we foresee an increase of multiples, in a sector that is much more profitable and solid than a few years ago.”

Read More: Payouts, Profits Ward Off Rates Doomsday for Banks: Taking Stock

©2024 Bloomberg L.P.