Oct 30, 2023

European Gas Prices Jump After Egypt Says Imports Stopped

, Bloomberg News

(Bloomberg) -- European natural gas prices steadied as traders took stock of immediate supply risks from the Israel-Hamas war, which remains contained to a relatively small region even as it intensifies.

December futures closed little changed after fluctuating earlier. The contract initially surged amid worries that a halt in Israeli supplies to Egypt might affect onward flows to Europe, though prices eased throughout the day.

Still, the market remains on edge about the possibility of a wider conflict. Israel extended ground operations in Gaza, while promising that aid flows will increase as concerns mount over the humanitarian situation.

Israel Latest: Army Says Captive Soldier Freed in Ground Fight

Gas production at Israel’s Karish field resumed late last week following a brief outage, a spokesman for operator Energean Plc said Monday. However, the status of Israel’s gas exports to Egypt and Jordan remains unclear.

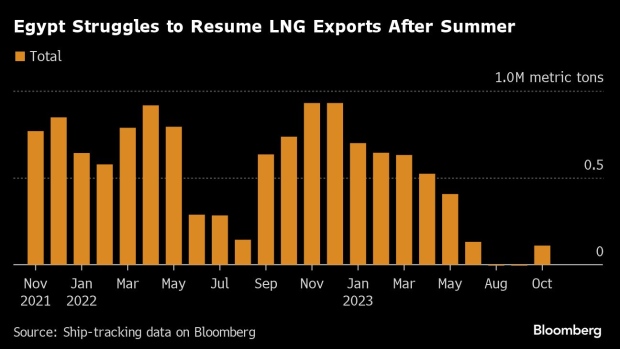

Egypt’s cabinet on Sunday said there was no gas flowing from Israel, raising questions about Egypt’s ability to send liquefied natural gas onward to Europe. The North African country depends partially on Israeli gas to meet domestic demand and export the fuel via two LNG plants. High domestic consumption in the summer halted exports.

Although Egypt typically provides just a sliver of Europe’s gas, an escalation of the Israel-Hamas war could send shockwaves through the Middle East and energy markets. Of particular concern is the Strait of Hormuz, a vital waterway for the transport of crude oil and LNG.

The market is “trying to price in a risk premium related to a wider disruption to supplies through the Strait of Hormuz, the risk of which for now seems limited,” said Ole Hansen, head of commodities strategy at Saxo Bank A/S.

December futures, the most active contract, settled at €53.03 a megawatt-hour. The November expired Monday, also little changed. Front-month prices are still about 30% higher than they were before Hamas’s attack on Israel on Oct. 7.

Meanwhile, Europe’s gas storage facilities are 99% full on average, helping reduce the impact of any supply disruptions, but the winter heating season still lies ahead.

“Europe is starting the heating season with record-high stocks acting as a buffer,” said James Waddell, head of European gas and global LNG at Energy Aspects. However, the loss of any flows would add upward pressure to prices.

“Gas needs to stay broadly uncompetitive with coal to preserve high stocks going into next summer, given the difficulty of refilling next year,” Waddell said.

--With assistance from Laura Hurst, Salma El Wardany and Priscila Azevedo Rocha.

©2023 Bloomberg L.P.