Nov 30, 2022

European Landlords Want to Sell But Buyers Are on Strike

, Bloomberg News

(Bloomberg) -- Europe’s biggest public landlords are planning a swathe of major asset sales as they look to slash debt in the face of rising rates. Their timing could hardly be worse.

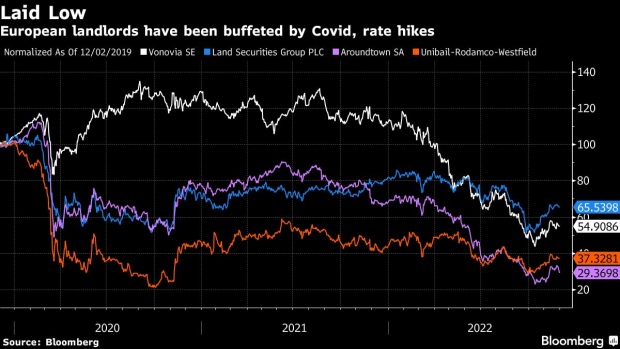

Companies including Vonovia SE, Land Securities Group Plc and Unibail-Rodamco-Westfield have announced plans to sell large chunks of their portfolios to shore up balance sheets, but rampant inflation and rapidly rising interest rates are deterring deals.

All told, at least €23 billion ($24 billion) of assets owned by the continent’s largest public landlords are earmarked for sale, according to Bloomberg calculations. The true amount is likely far higher as the figure doesn’t include companies that haven’t stated disposal targets or discussed specific assets to be sold.

In a turnaround from the boom years, buyers are wary of committing just when values could be on the cusp of a double-digit correction and volatility makes debt expensive and hard to find. That’s leading to a standoff.

“The investment market is experiencing a complete transaction freeze,” Thierry Beaudemoulin, chief executive officer of Adler Group SA, said Tuesday after the company announced a debt restructuring deal following the failure to complete a series of planned sales. Buyers “are afraid to catch a falling knife.”

Landlords are grappling with higher borrowing costs that are starting to feed through to asset values after central banks began aggressively hiking interest rates. That’s weighed heavily on share prices as investors fret about their relative indebtedness, which increases as asset values fall.

Adler has been under even more extreme pressure than most of its peers. Short-seller allegations last year led to a collapse in the company’s shares and limited its options for refinancing. That’s made it a forced seller, looking to do deals as quickly as possible. The company denies accusations of fraud, but has struggled to find an auditor after KPMG quit in May.

The landlord managed to sell two large portfolios earlier this year before rate hikes began to bite. It has since earmarked two other portfolios as well as most of its development projects and a stake in Brack Capital Properties NV for sale, but has yet to find buyers. An expensive restructuring plan that’s been agreed by some creditors would give it two years of breathing space to sell down the assets in a more orderly fashion.

Still, even the continent’s biggest landlords face headwinds. Vonovia unveiled plans to sell at least €13 billion of assets in August in an attempt to cut debt levels that were worrying investors. The company’s third-quarter earnings statement published earlier this month contained little detail on progress.

“So far there is scant evidence that sizable disposals are imminent, not least because Vonovia’s management is anchored to stale book values,” real estate research firm Green Street wrote in a note to clients earlier this month.

Vonovia and its listed peers have accounted for about 40% of the transactions in Germany’s residential property sector in recent years. All of them are now “aspiring net sellers,” Green Street said, adding that debt-backed buyers such as private equity firms are also on the sidelines.

Some landlords including Land Securities and Unibail-Rodamco-Westfield have been pursuing large disposal programs for several years and have made substantial progress. LandSec, as the company has rebranded itself, is about half way to achieving a £4 billion sales plan unveiled in 2020. URW unveiled an initiative to dispose of €4 billion in properties last year and has now secured deals for about €3.2 billion.

URW effectively acknowledged that the pace is slowing when it announced third-quarter earnings that contained “no new news on disposals,” Royal Bank of Canada analyst Julian Livingstone-Booth wrote in a note to clients.

LandSec sold Deutsche Bank AG’s new London headquarters in September after a protracted negotiation that resulted in a lower price than originally expected. Even that deal that might not have happened had it not been closed a few days before former Prime Minister Liz Truss unveiled plans for unfunded tax cuts that triggered a wave of volatility, Chief Executive Officer Mark Allan told the Times newspaper earlier this month.

While LandSec has relatively low debt levels that ease the pressure to sell, other landlords are in a tougher situation. Swedish landlord Samhallsbyggnadsbolaget i Norden AB has been targeted by a short seller and is rushing to improve its finances. The company denies the allegations.

The landlord, known as SBB, announced Wednesday it would sell a stake in its portfolio of public-education properties to private equity firm Brookfield for as much as 10.4 billion kronor ($983 million). The price will depend on earn out fees and could represent either a small discount or a slight premium. The proceeds will bring down SBB’s loan-to-value ratio to 42.4% from 46.9% at the end of the third quarter, it said.

The deal brings SBB’s string of divestments to as much as 25 billion kronor in total, which should bolster the company’s credit grade, Chief Executive Officer Ilija Batljan said in comments relayed by a spokesperson.

“This is completing our disposal program in terms of where we want to be to have a strong financial position,” he said on a conference call.

Aroundtown SA has also been seeking to reduce its debt exposure, which stands at about 40% of its book value. The pan-European landlord has ramped up disposals since the coronavirus pandemic as lockdowns hurt its hotel and retail properties.

The company has sold about €1.1 billion of property so far this year, adding to the €2.3 billion signed in 2021, according to a statement Tuesday. While the company has sufficient liquidity to see it through to 2025, short interest has been building and now stands at almost 12% of its freely traded shares.

The landlord declined an early redemption option on subordinated bonds and said it will review whether to defer coupon payments, triggering a wider slump in real estate hybrid bonds on Tuesday.

S Immo AG, an Austrian landlord, has resorted to selling properties in smaller deals to high net worth individuals because institutional buyers are “more or less not in the market anymore,” board member Herwig Teufelsdorfer said on an earnings call this week.

Private equity firms including Blackstone Inc. have raised record sums for real estate investment that’s mostly sitting on the sidelines, signaling the possibility of more deals if and when would-be sellers begin to accept discounts. So far they’re mostly holding out, but the pressure is building.

“You won’t believe how many indecent proposals you get when the market perceives that you are in trouble,” Adler Chairman Stefan Kirsten said Tuesday.

--With assistance from Marton Eder and Anton Wilen.

(Updates to add SBB comments. A previous version contained an incorrect debt ratio for SBB)

©2022 Bloomberg L.P.