Feb 17, 2022

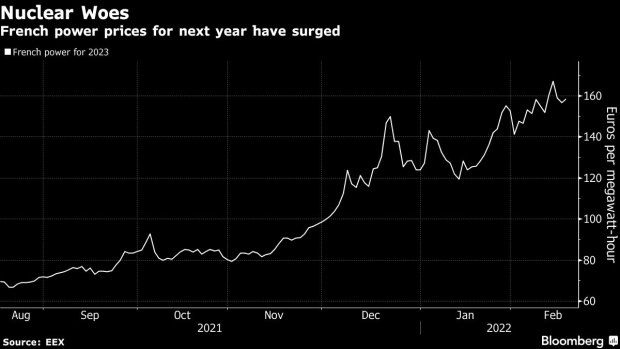

European Power Prices Could Spike in Spring Amid Nuclear Woes

, Bloomberg News

(Bloomberg) -- European electricity prices could spike again in the coming months as French reactor outages and low hydropower stocks tighten the market, S&P Global Platts said.

The region’s power and gas prices have been whipsawed this year by tensions between Russia and the West over Ukraine. While a mild winter in Europe has kept a lid on gains in recent weeks, underlying supply concerns -- such as cuts to French nuclear-output forecasts and a lack of water for power generation in southern Europe -- threaten to send prices higher.

“In the near term, we see upside risk for prices shift from the remainder of winter to the summer months after mild and windy weather conditions have prevailed in northwest Europe for much of the first quarter,” said Sabrina Kernbichler, a power analyst at S&P Global Platts.

German power for next month climbed as much as 5.2%, before paring gains to trade up 1.9% at 154 euros a megawatt-hour on the European Energy Exchange AG.

The benchmark power contract may have eased since soaring to a record in December, but traders remain on edge. While some have profited from the volatility, others have been caught out. Germany’s RWE AG on Thursday raised its earnings outlook on stronger generation margins, while Norway’s Statkraft AS’s wholesale energy trading unit reported its biggest ever loss.

Persistent price volatility “increases the risk for suppliers to take a position in the market and tends to increase the cost of trading,” Kernbichler said. “These higher costs could eventually filter through to end-consumers.”

EDF slashed its nuclear-output forecast last week as it continued to repair several reactors, predicting production levels not seen since 1990. The move sent French power for 2023 up more than 5%.

“The latest update is particularly worrying for the market, as reduced nuclear generation will extend and exacerbate the European power crunch and continue to put pressure on the already-tight supply situation for electricity in France,” said Fabian Ronningen, an analyst at consultant Rystad Energy AS in Oslo.

The supply squeeze could also be exacerbated by low hydro stocks in southwest Europe, including in Italy, Spain and Portugal, Kernbichler said. A relatively low snowpack in the Alps will limit water inflows to reservoirs during the snowmelt season, she said.

©2022 Bloomberg L.P.