Nov 16, 2023

European Stocks Drop as Post-Inflation Joy Fades; Burberry Sinks

, Bloomberg News

(Bloomberg) -- European equities retreated after three days of gains as a warning from Burberry Group Plc pulled the region’s top luxury stocks lower, while HelloFresh SE sank by a record after cutting its outlook.

The Stoxx Europe 600 Index was down 0.7% by the close, with energy, retail and travel and leisure stocks lagging the most, while defensive sectors such as utilities and telecom outperformed. Burberry fell after the British fashion firm said that this year’s revenue target may be out of reach, roiling larger peers. Meanwhile, Siemens AG rallied as analysts noted its fourth-quarter report delivered a strong showing overall.

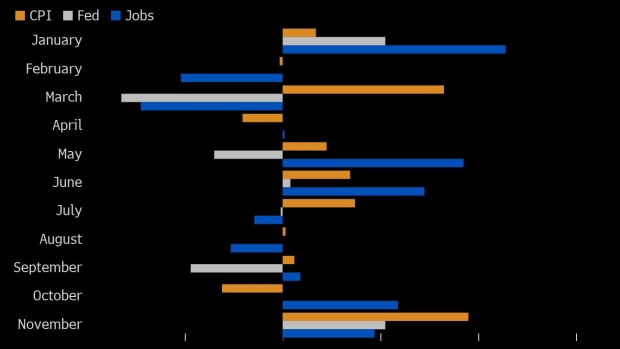

Thursday’s pullback follows gains on the back of below-forecast inflation prints in the US and the UK, which encouraged the view that central banks will end their aggressive interest-rate hiking campaigns. The main regional gauge on Wednesday hit its highest level in nearly two months and is now up 6.2% this year.

“It is clear that inflation will remain high for a longer period of time, so uncertainty about the economic impact will return,” said Guillermo Hernandez Sampere, head of trading at asset manager MPPM.

Shares of Hotel Chocolat Group Plc soared as Mars Inc., the US candy company, agreed to buy the British firm for £534 million ($662 million), adding to a spree of takeover deals among the UK’s small and mid-cap companies.

Investors are already turning to prospects for 2024, with Barclays strategists preferring global equities to bonds for next year. They predict stocks will show “high single-digit returns” and outperform core fixed income, as they “look through” an economic slowdown.

For more on equity markets:

- Welcome to an Everything Rally as Markets Go Bling: Taking Stock

- M&A Watch Europe: Hotel Chocolat, EQS, Sanofi, Pershing Square

- Alstom’s €1 Billion Lesson in How Not to Raise Funds: ECM Watch

- US Stock Futures Little Changed; Cisco, Maxeon Solar Fall

- Reckitt Picks Ex-Sky CEO as New Chair: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

©2023 Bloomberg L.P.