Dec 1, 2023

European Stocks Set to Hit Record High in 2024, Citi’s Manthey Says

, Bloomberg News

(Bloomberg) -- European stocks are likely to hit a record high next year as “the balance of macro risks” is improving, according to Citigroup Inc.’s Beata Manthey.

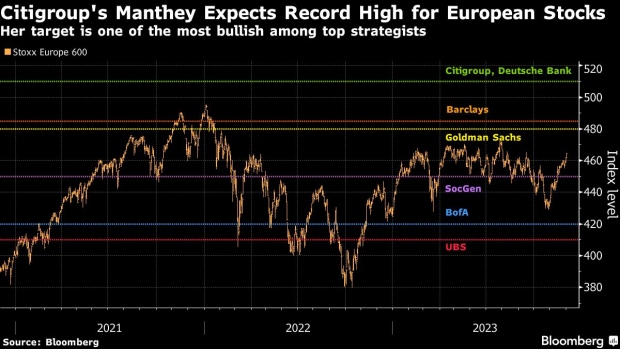

A Citigroup model that adjusts for the impact of interest rates suggests that “Europe already has the most bad news in the price,” the strategist wrote in a note. She expects the regional benchmark Stoxx 600 Index to end 2024 at 510 points — a target shared by Deutsche Bank Group AG. Her forecast implies gains of about 10% from the current level, and is one of the most bullish among Wall Street strategists.

Manthey said investors may have become too pessimistic about the outlook for corporate earnings amid an economic slowdown. That’s opened up a “buffer” for stock prices if profit estimates are downgraded and also suggests the bar is lower for companies to beat analyst expectations.

Manthey has remained optimistic on European equities even as they trailed US peers, where the buzz around artificial intelligence fired up shares of technology behemoths. Market forecasters broadly expect the US to retain its lead next year, with a range of strategists predicting a record high for the S&P 500.

In Europe, however, the likes of Bank of America Corp. and Societe Generale SA see declines due to the impact of a slowing economy and interest rate hikes.

Citigroup economists also expect relatively soft global economic growth next year, Manthey said. However, a drop in inflation, abating geopolitical risks and a potential trough in European business activity bode well for stocks, she said.

©2023 Bloomberg L.P.