Mar 9, 2020

Even Utilities and Real Estate Can’t Escape the Market Rout

, Bloomberg News

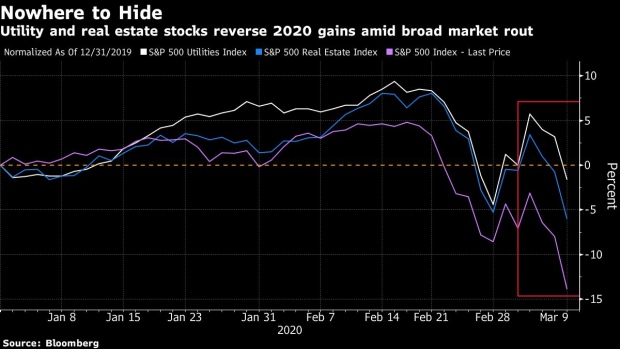

(Bloomberg) -- Real-estate stocks and utilities joined in the latest market rout, showing that even traditional havens that should benefit from lower yields aren’t safe amid a panicked sell-off.

The S&P 500 Real Estate Index declined as much as 6.2% Monday, the most since 2011, reversing this month’s gains despite rising expectations that the Federal Reserve will cut policy rates to zero. Meanwhile, the S&P 500 Utilities Index fell as much as 5.2%, paring its March rally.

The stock performance shows that global headwinds like the eruption of an oil-price war and the spreading outbreak of the novel coronavirus are starting to take their toll even on stocks that traditionally benefit from a flight to safety.

Within real estate, declines in shares of real estate investment trusts like Simon Property Group Inc. that promise yields “well north of 6%” and generally safer REIT groups like apartments and student housing show “that the market is taking a broad brush and just selling everything,” Piper Sandler’s Alexander Goldfarb said in a phone interview.

“Right now, the market’s not looking for bucking of trends,” he said. “Today, if it’s a stock, it’s getting sold.”

To contact the reporter on this story: Andres Guerra Luz in New York at aluz8@bloomberg.net

To contact the editors responsible for this story: Catherine Larkin at clarkin4@bloomberg.net, Kristine Owram, Will Daley

©2020 Bloomberg L.P.