Dec 3, 2023

Evergrande Winding-up Hearing in Hong Kong Adjourned to Jan. 29

, Bloomberg News

(Bloomberg) -- China Evergrande Group won breathing room to strike a restructuring agreement with creditors after a Hong Kong court again pushed back a decision on whether the world’s most-indebted property developer should be wound up.

The proceedings have been adjourned to Jan. 29, Judge Linda Chan said in the city’s High Court. The unexpected delay came as the original petitioner didn’t push for an immediate liquidation on Monday, an about-turn that caught Evergrande and other creditors off guard and marked the latest twist in a lawsuit that has dragged on for more than a year.

Dozens of people queued outside the court room early Monday to hear the ruling on the builder’s financial fate. In giving Evergrande another eight weeks to hammer out a deal, the judge said its proposal still lacked some crucial details, and requested that it seek input from “relevant authorities” and garner wider support from creditors.

“The petitioner changed its position and didn’t push to wind up the company, which is a surprise to us,” Neil McDonald, a partner at law firm Kirkland & Ellis LLP, legal adviser to an ad-hoc group of creditors, said in an interview outside the court. Meanwhile, the creditor group has “has firmly rejected” the latest proposal that Evergrande put forward to the court, he added.

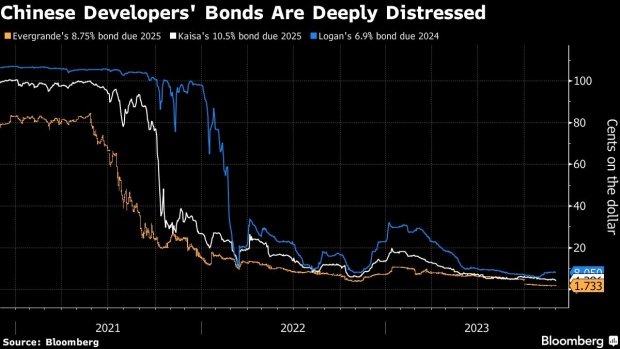

The builder’s shares rallied as much as 22% on the adjournment decision, but pared a bulk of the gains to end the day up 9%. At a value less than HK$0.30, it remains a penny stock. Its bonds have been trading at deeply distressed levels at around one cent on the dollar.

Uncertain Fate

While Evergrande has now earned some time to avert a liquidation, much remains uncertain on what will transpire at the next hearing. Observers are skeptical that it would manage to reach a dramatic deal with creditors after failing to do so for so many months.

Offshore creditors had demanded controlling stakes in the equity of Evergrande as well as its two Hong Kong subsidiaries — Evergrande Property Services Group and China Evergrande New Energy Vehicle Group — as part of the debt discussions, Bloomberg News reported last week. Evergrande had earlier proposed offering 17.8% of the parent and 30% of each of the subsidiaries.

“I think it would be the last chance of delay for offshore investors and the company to finalize on the restructuring plan before the company might get wound up in the next hearing,” said Kenny Chung, a portfolio manager at Astera Capital, a Hong Kong-based investment firm.

The petition for liquidation was filed in June 2022 by Top Shine Global Limited of Intershore Consult (Samoa) Ltd., which was a strategic investor in the homebuilder’s online sales platform, and subsequently became a consolidated class action for other frustrated creditors.

Top Shine’s lawyer declined to elaborate on its position change on Monday. Judge Chan asked Top Shine to notify others before the next hearing should it choose not to seek liquidation.

When asked whether the ad-hoc group would step in to continue to push for a wind-up if the petitioner dropped the lawsuit, McDonald, the legal advisor for creditors, said “likely, yes.”

A separate lawyer representing bondholders said Evergrande’s latest proposal will lead to a “materially worse recovery” compared to a liquidation.

Spiraling Crisis

In a separate hearing, Judge Chan adjourned winding-up petitions against two units of Chinese builder Logan to Jan. 8.

China’s property slump is deepening despite policy measures to put a floor the market’s slump that began three years ago with a crackdown on the industry’s reliance on debt. The International Money Fund warned earlier this year that the trouble could spill over to the financial industry and local government if confidence is not restored.

Evergrande has become a poster child for China’s real estate troubles since the builder defaulted two years ago. It reported a combined loss of $81 billion in 2021 and 2022.

After several delays in bringing forward a restructuring plan, the Shenzhen-based company tried to secure creditor approval for its offshore-debt proposals in late August before delaying the meetings further, leaving the rescue in limbo.

The developer’s lawyer said earlier this year that Deloitte estimated the recovery rate for the company’s notes would be 3.4% on average if the firm is liquidated compared with 22.5% in a restructuring.

Regardless of how the Hong Kong court rules, the priority for Evergrande’s assets in mainland China will be to deliver unfinished projects to homebuyers, said Zhang Kaikai, investment director with Shanghai Gofar Asset Management Co. Even if the court issues a wind-up order, it will be difficult to divest the developer’s onshore assets for offshore investors in a short period of time, he added.

--With assistance from Venus Feng, Alice Huang, Shuiyu Jing and Kari Lindberg.

(Updates with more details from court ruling, money manager comments.)

©2023 Bloomberg L.P.