Jan 16, 2024

Exclusive UK Bond Club's First New Member in Over 12 Years Is a Canadian Bank

, Bloomberg News

(Bloomberg) -- After becoming the first new addition to a prestigious club of UK bond dealers since 2011, Bank of Montreal is looking to use the role as a springboard into European debt markets.

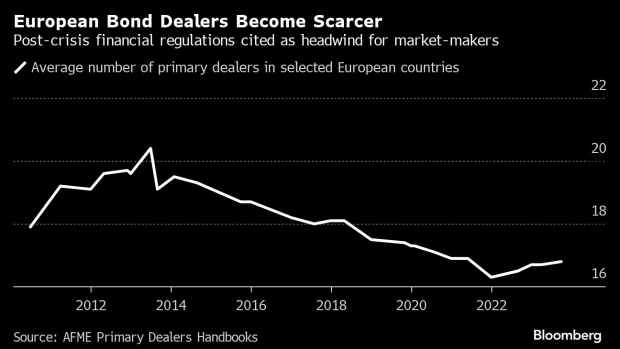

The Canadian bank debuted as a so-called retail gilt-edged market maker on Monday — joining a shrinking pool of primary-dealer banks that buy bonds directly from the government. Societe Generale SA, Jefferies Financial Group Inc. and Credit Suisse Group AG are among those to have left the UK bond market amid tough regulation and dwindling profitability in the past decade.

Until now, BMO hasn’t acted as a primary dealer outside North America, and the expansion is part of its European strategy, according to Summer Hinton, who heads the international division of the bank’s global markets team. The bank may seek other primary dealer roles on the continent, she said.

It’s a “fractured landscape of primary dealerships, and market participation in Europe is incredibly complicated and incredibly expensive,” she said. “We looked at the broad landscape and for us, sterling made the most sense to start with.”

By purchasing bonds directly from the government and selling them on, primary dealers help create a liquid market for the state’s debt. But since the 2008 financial crisis, the role has become less profitable as banks were required to hold extra capital against possible losses.

After peaking at 21 banks a decade ago, there are now 18 official gilt dealers. Robert Stheeman, the outgoing chief executive of the UK’s Debt Management Office, warned that lenders’ traditional dominance of the pivotal role could come under threat from other market makers.

Looking to Europe

BMO is now a retail GEMM, where the requirements aren’t as stringent as for a fully-fledged dealer. That follows the departure of Jefferies in 2022.

The retail accreditation allowed BMO to enter the market “relatively quickly,” according to Hinton, though she says it’s possible the bank could eventually become a wholesale dealer. BMO has hired two sterling rates traders, as well as associated quants, middle- and back-office staff, she said.

At the same time, as a retail GEMM, the bank isn’t able to manage gilt syndications or receive the associated fees.

BMO is also expanding its euro swaps business, according to Ralph Sherman, the bank’s head of digital and liquid products trading in EMEA.

“There’s a lot of infrastructure to build — for example quants and trade support hires and things like that,” he said. “I think it would’ve just been a step too far to try and do that at the same time as becoming a wholesale GEMM.”

(Updates with Jefferies’ exit in fifth-to-last paragraph and BMO staffing details in fourth-to-last paragraph.)

©2024 Bloomberg L.P.