Nov 4, 2020

Facebook leads Big Tech stock surge on gridlock election bet

, Bloomberg News

BNN Bloomberg's afternoon market update: November 4, 2020

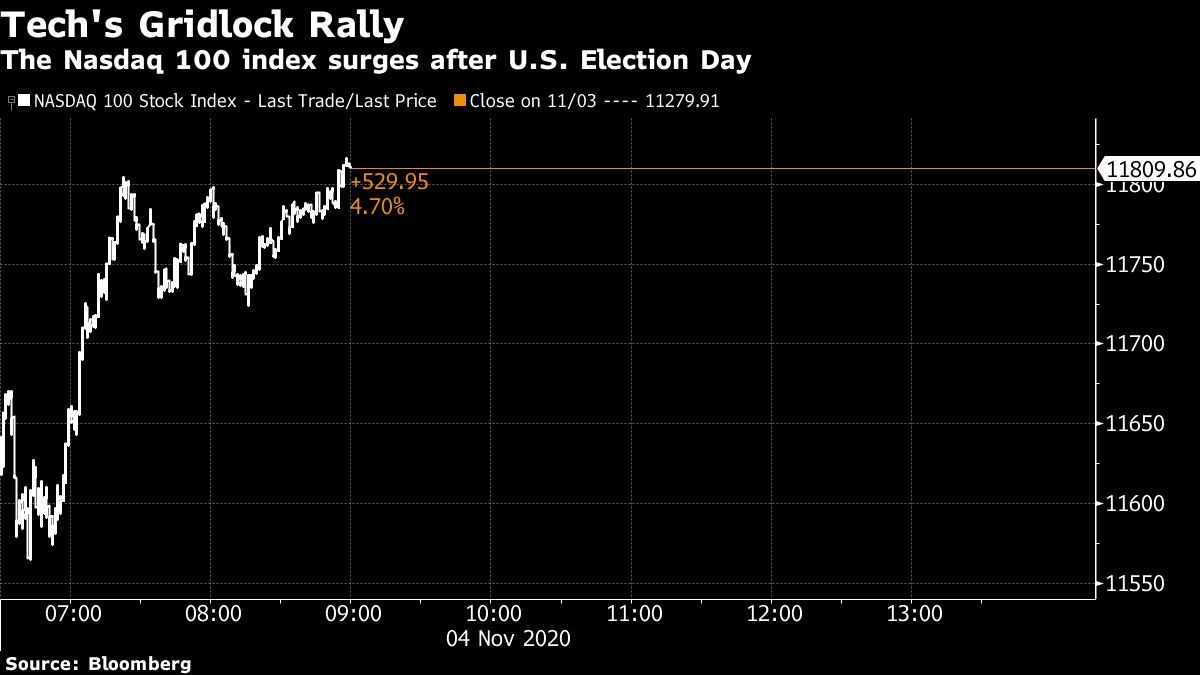

Big technology stocks surged on Wednesday as investors bet that likely Republican control of the Senate could create gridlock in Congress, limiting new legislation that may have weighed on the industry.

Facebook Inc. jumped more than seven per cent, the biggest intraday gain since late August. Google parent Alphabet Inc. climbed more than six per cent, while Amazon.com Inc. rose 5.6 per cent and Apple Inc. added three per cent.

Democratic prospects of taking control of the Senate faded on Wednesday after several vulnerable Republican incumbents fought off well-financed Democratic challengers. That helped ease concerns about big changes to U.S. antitrust laws targeting the largest internet platforms.

”We now see a material reduction in the possibility of a meaningful overhaul to existing antitrust law,” Evercore ISI analysts wrote in a research note on Wednesday. Facebook and Alphabet are “major winners on this front,” followed by Amazon, they said.

Before Election Day, the tech industry was facing major regulatory threats. The Justice Department filed a landmark monopoly suit against Google and legislation was being prepared based on a recent House report alleging wide-ranging antitrust violations by Google, Facebook, Apple and Amazon.

While the election results are still unknown, a “Blue wave” now looks unlikely, reducing the chances that the Senate will pass any major new laws attacking the tech industry.

“The Market/Nasdaq is betting that whatever happens in the Presidential election the Senate will stay in the Republican majority,” Dan Morgan, a senior portfolio manager at Synovus Trust Company, wrote in an email. “A Democrat-controlled Senate would be more likely to create overhauls and fines on Tech giants. Whereby, a Republican controlled Senate (which seems to be most likely) would have a more laissez-faire stance.”

Morgan also said that a Republican-controlled Senate would reduce the chance of an increase in capital gains taxes.

“A massive capital gains increase is not going to get through a Republican controlled Senate,” he said. This has a “big positive impact” on large tech stocks that have generated huge profits for shareholders in recent years, he added.