Mar 24, 2023

Fed’s Bullard Lifts His 2023 Rate Forecast on Strong Growth

, Bloomberg News

(Bloomberg) -- Federal Reserve Bank of St. Louis President James Bullard said that he had raised his forecast for peak interest rates this year amid ongoing economic strength, based on an assumption that banking-sector strains will prove temporary.

“I had previously been at 5-3/8, now I’m at 5-5/8, so a little bit higher — 25 basis points higher — in reaction to the stronger economic news,” he told reporters via conference call Friday after a speech. Bullard added that the upgrade was “also under the assumption that the financial stress abates in the weeks and months ahead.”

“There could a downside scenario where financial stress gets worse, but I didn’t make that my base case,” he said, adding that he viewed only a 20% chance of that pessimistic outcome playing out.

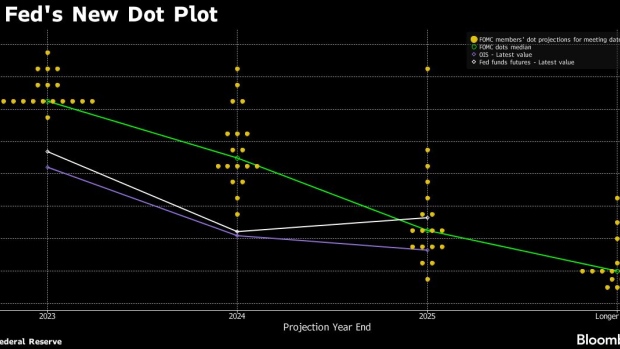

Fed officials raised their benchmark policy rate by 25 basis points on Wednesday to a 4.75% to 5% target range and projected rates rising to 5.1% by the end of the year, according to the median forecast of the 18 policymakers.

The Fed’s so-called “dot plot” of rate forecasts indicated that two other officials shared Bullard’s estimate of 5.625%, and one was higher at 5.875%.

Such forecasts are roughly 2 percentage points higher than where traders are betting Fed rates will be in January. Investors are betting the Fed will cut rates starting in June.

Policymakers must balance the imperative of bringing inflation back down to their 2% target — it rose 5.4% in the 12 months through January — with the danger that their actions could make strains in the banking sector worse.

The US government stepped in to guarantee deposits at two failed US banks and after the Fed introduced a new emergency lending program meant to backstop other institutions. The Fed also worked to boost international access to dollars by enhancing swap lines with its key central bank counterparts after tensions spread to Europe. Swiss authorities at the weekend oversaw the shotgun marriage of Credit Suisse Group AG and its neighbor and rival UBS Group AG.

In an interview earlier Friday with NPR News, Atlanta Fed President Raphael Bostic also expressed confidence in the financial system and said that the decision to raise interest rates by 25 basis points this week in the midst of a banking crisis was not taken lightly.

“There was a lot of debate, this wasn’t a straight-forward decision, but at the end of the day, what we decided was there’s clear signs that the banking system is sound and resilient,” Bostic said. “And with that as a backdrop, inflation is still too high.”

Fed Chair Jerome Powell said a press conference Wednesday that the question of a pause had been considered in the days before the meeting, but during the gathering the consensus for an increase was strong. Powell also emphasized that the US banking system was “sound and resilient.”

(Updates starting in the third paragraph with more Bullard comments and context)

©2023 Bloomberg L.P.