Oct 9, 2023

Fed’s Logan Says Higher Yields May Mean Less Need to Raise Rates

, Bloomberg News

(Bloomberg) -- Federal Reserve Bank of Dallas President Lorie Logan said the recent surge in long-term Treasury yields may mean less need for the US central bank to raise its benchmark interest rate again.

“Higher term premiums result in higher term interest rates for the same setting of the fed funds rate, all else equal,” Logan said Monday in remarks at the National Association for Business Economics meeting in Dallas.

“Thus, if term premiums rise, they could do some of the work of cooling the economy for us, leaving less need for additional monetary policy tightening.”

In bond investing, the term premium is often defined as the extra compensation that investors require for bearing interest-rate risk over the life of the bond. Logan said “there is a clear role for increased term premiums in recent yield curve moves,” though “the size and persistence of the contribution are subject to uncertainty.”

Read More: How Rising Rates, US Debt Brought Back Term Premiums: QuickTake

On the other hand, “to the extent that strength in the economy is behind the increase in long-term interest rates,” the central bank may need to tighten more, Logan said.

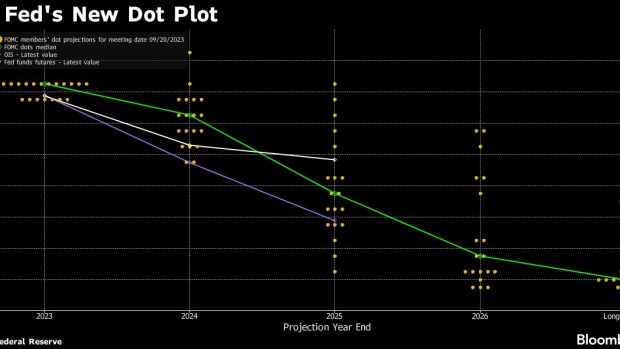

Fed officials are trying to decide whether they need to hike their benchmark federal funds rate again this year after raising it by more than five percentage points over the last 19 months. The yield on 30-year Treasury securities rose above 5% last week, the highest since 2007, amid an ongoing adjustment in markets to the Fed’s message that rates are likely to remain higher for longer than previously thought.

Better Balance

Speaking separately at an American Bankers Association event Monday, Fed Vice Chair for Supervision Michael Barr downplayed results of a monthly Bureau of Labor Statistics report published Oct 6, which showed stronger-than expected employment growth in September.

“There are important elements of the labor market that are showing that labor supply and labor demand are coming into better balance,” Barr said, citing cooler wage growth. “The picture is one that is showing that we have made significant progress on bringing inflation towards the direction we want.”

Answering questions after her speech, Logan argued “we have more work to do, and I think restrictive financial conditions will be will be needed for some time.”

“The most important thing is that we stay focused on on restoring price stability, and I think that will require some rebalancing in the labor market,” she said.

Investors currently see less-than-even odds of another rate increase this year, according to futures. Logan’s comments Monday jibed with recent remarks from San Francisco Fed President Mary Daly, who suggested on Oct. 5 that “if financial conditions, which have tightened considerably in the past 90 days, remain tight, the need for us to take further action is diminished.”

(Updates with Barr’s comments in seventh paragraph. An earlier version corrected date of Daly’s speech in final paragraph.)

©2023 Bloomberg L.P.