Oct 26, 2022

Fed’s Yield-Curve Barometer Starts Flashing Recession Risk

, Bloomberg News

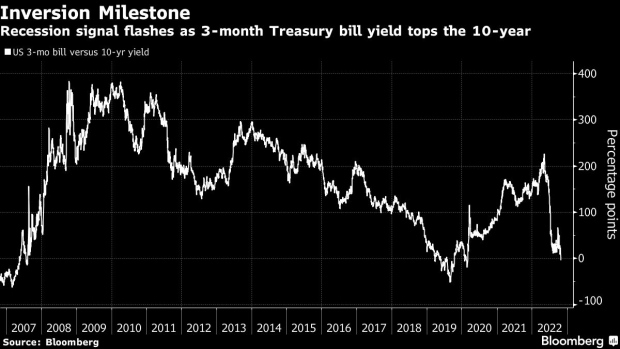

(Bloomberg) -- A classic recession warning is flashing in the US Treasury market, where the 10-year note’s yield fell below the three-month bill’s, a rare occurrence that signals investors anticipate dire economic consequences of the Federal Reserve’s campaign against inflation.

The 10-year dipped as much as 0.08 percentage point below the three-month in US trading Wednesday, after brief and smaller inversions Tuesday and in early August. The day’s lows for both yields were reached shortly after the Bank of Canada raised its policy rate by half a percentage point, less than expected.

Inversions of this segment of the Treasury curve typically occur late in Fed tightening cycles as three-month bills track the policy rate while longer-term borrowing costs reflect expectations for economic growth and inflation. While other widely-watched yield curve segments such as the two- to 10-year and five- to 30-year have been deeply inverted for much of this year, the Fed follows this one more closely.

“We are certainly in territory with the Fed’s official barometer of the yield curve that will raise concerns,” said Gregory Faranello, head of US rates trading and strategy at AmeriVet Securities. “The Fed will definitely watch this, and there is a sense in the bond market that they will soon throttle back the pace of rate hikes and take a step back.”

Another three-quarter-point hike from the current 3% to 3.25% range is still expected for next week’s policy meeting, based on swap contracts referencing the event, but traders are divided on whether the subsequent move will be 50 or 75 basis points in December.

As the US central bank tries to use rate increases to bring down inflation, the risk is that economic activity responds more quickly, and that the Fed won’t lower rates until there’s progress on inflation.

Long-dated Treasuries rallied sharply Tuesday after gauges of home prices and consumer confidence declined more than expected. US 30-year fixed mortgage rates topped 7% last week for the first time in two decades, an example of how Fed rate increases are flowing through to the economy.

Inversions of the three-month to 10-year yield curve have heralded past recessions. The curve inverted as much as 0.28 percentage point in March 2020 and became deeply negative in 2019, 2007 and 2000, all at the end of Fed tightening cycles.

While the prospect of more Fed hikes maintains upward pressure on bill yields, the 10-year is in retreat from multiyear highs. It peaked at 4.34% last week, up from 1.5% in January. Buying now may prove rewarding as economic weakness broadens, possibly leading to rate cuts by late 2023 or 2024.

“It will be difficult for the Fed not to overtighten as inflation will lag the economy and they are so focused on slaying the inflation dragon,” said Donald Ellenberger, senior portfolio manager at Federated Hermes. “It’s a time for sticking with quality bonds and we have no problem extending duration in Treasuries.”

Positioning surveys this week revealed investors have been adding more interest-rate risk to their portfolios to benefit from declining long-term yields. The SMRA portfolio survey was net long for the first time since 2021, while JPMorgan Chase & Co.’s Treasury client survey was most bullish in two years.

“Our duration was shorter than the index for most of the year and we began getting closer to neutral a month ago when the 10-year was around 3.55%,” said Ellenberger. “We were a little early and we do think the bulk of the upward adjustment in yields is behind us.”

(Adds context and comments beginning in sixth paragraph.)

©2022 Bloomberg L.P.