Jan 23, 2024

From Man Group to Oaktree, Firms Are Buying Bank Bonds That Cut Risk

, Bloomberg News

(Bloomberg) -- Private equity and hedge fund firms are preparing to snap up a wave of synthetic securitizations issued by US banks seeking to offload their exposure to everything from auto loans to mortgage-backed bonds.

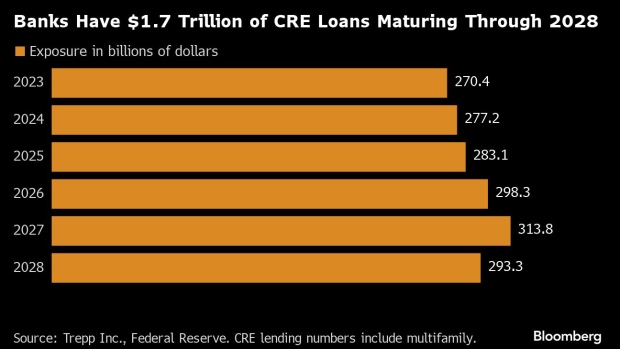

Lenders are looking to shed risk after interest rate increases left them with unrealized losses of $683.9 billion on securities in the third quarter. Smaller lenders also face a significant hit from commercial real estate, with almost $1.5 trillion of bank credit linked to those buildings due to mature through 2028.

“Activity is noticeably higher than prior years,” Kaelyn Abrell, a partner and portfolio manager at ArrowMark Partners, said in an interview. “Over the last two years, U.S. and Canadian banks have been the most active issuers and underlying exposures have ranged from revolving lines of credit to auto loans.”

For the asset managers, deals such as credit risk sharing give them the chance to deploy their dry powder and generate returns that can be in the double digits, while the banks get to maintain their client relationships. Regulatory pressures have driven the lenders to derisk and pull back from certain types of lending, prompting funds to muscle in and profit.

“Both regional and large banks” are “sitting with big embedded losses on their balance sheets,” Bob O’Leary, a managing director at Oaktree Capital Management Ltd. said in a December webcast.

‘Pretty Uncomfortable’

“These losses might not have to be recognized immediately, but the people running the risk books for those banks probably feel pretty uncomfortable,” he said. “They’ll likely look to shed that risk.”

US banks revived the sale of credit-linked notes last year, for example, ahead of finalized Basel III regulations that will require them to hold more capital. The use of credit default swaps in the notes means the issuer essentially transfers the credit risk to investors.

Magnetar Capital, Ares Management Corp., KKR & Co. and Blackstone Inc. have been among the purchasers of credit-linked notes. Returns can be in the high teens for the riskiest transactions, according to ArrowMark’s Abrell.

GoldenTree Asset Management’s 15% gain in its $10.7 billion master fund last year was in part due of its holding of synthetic risk transfer products from European banks, according to a person with knowledge of the matter.

Man Group Plc., the world’s biggest publicly-traded hedge fund, is also making a push into the space by partnering with banks and using quant tools to analyze the risk from each transaction.

“We’re seeing unprecedented supply of credit risk transfers,” Eric Burl, the firm’s head of discretionary, said in a December interview. “More than ever, banks globally are looking at how to transfer risk.”

Helping to drive issuer interest was the Federal Reserve’s September decision to broaden the definition of capital relief via credit-linked notes, while retaining the right to say no to a lender issuing them. A number of lenders have since won approval to use synthetic securitizations, including US Bancorp.

Pushing Back

Still, one corner of the market for US mortgage default risk was temporarily roiled after insurer Arch Capital Group Ltd. called $1.7 billion of the securities at par in December when they had been trading at a premium. After investors pushed back, the company later said it would pay market prices.

The increasing use of the synthetic risk transfers has drawn criticism from Sheila Bair, the former chair of the US Federal Deposit Insurance Corporation.

The reduction in capital leaves lenders weaker in periods of turmoil, she wrote in The Financial Times last month, arguing that the SRTs may also make the financial system less stable because the non-bank purchasers are less able to manage and absorb any losses.

The International Association of Credit Portfolio Managers disagrees, saying that the counterparties don’t disappear when credit deteriorates and instead act as long-term partners of banks.

Some poorly underwritten debt issued over the five years through 2022 ended up being held by the banking industry, according to O’Leary at Oaktree. While banks can also opt for loan portfolio sales to reduce that exposure, risk transfers can provide “a more elegant” solution.

“We’re seeing an increase in the number of banks interested in talking to us about risk transfer involving high-quality assets that are simply mispriced,” he said in the webcast. “They were just purchased in an era that doesn’t exist right now.”

--With assistance from Nishant Kumar.

(Adds ArrowMark comment in third paragraph, updates chart on CRE debt)

©2024 Bloomberg L.P.