Nov 17, 2022

Gap jumps after posting better-than-expected earnings

, Bloomberg News

Gap hires head of Walmart Canada to lead Old Navy

Gap Inc. posted quarterly sales and profit that surpassed Wall Street’s estimates -- a sign the apparel retailer is making progress in controlling an inventory buildup that had eroded investor confidence earlier this year.

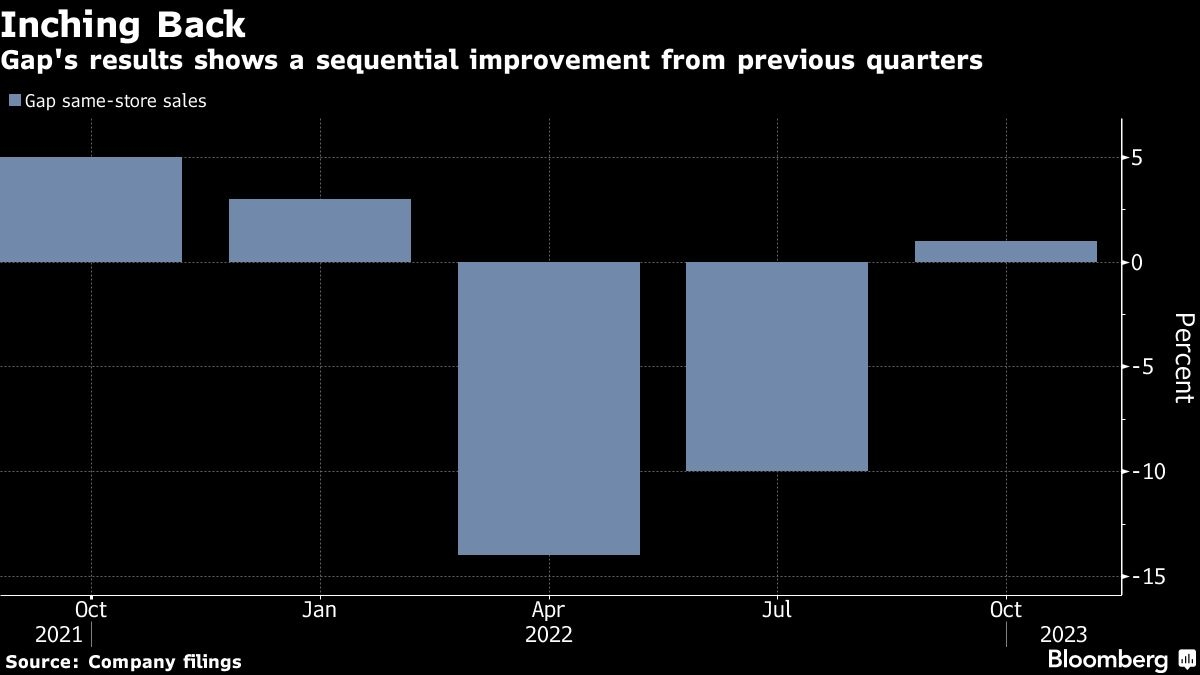

Comparable sales, a key gauge for retailers, rose 1 per cent in the quarter ended Oct. 29. That’s better than the 3.4 per cent decline from analysts surveyed by Bloomberg.

“We have sharpened our focus on execution to optimize profitability and cash flow,” interim Chief Executive Officer Bobby Martin said in a statement. The company is “bringing more rigor to our operations, and balancing our assortments in response to what our customers are telling us.”

The results show that shoppers may be taking advantage of widespread markdowns that started over the summer as a result of the retailer being saddled with excess inventory.

Inventories rose 12 per cent in the third quarter from a year earlier, compared with a 37 per cent increase in the second quarter, suggesting that the retailer was successful in paring down merchandise in the August to October period. Gap said it expects to have inventory more closely aligned with demand by the spring.

Gap shares rose 7 per cent to US$13.60 at 4:53 p.m. in after-hours New York trading. The stock has dropped 28 per cent in 2022 through Thursday’s close, more than the 12 per cent decline for the S&P 400 Midcap Index.

Comparable sales at the Gap namesake brand rose 4 per cent, thanks to a pickup internationally. By that measure, Banana Reputlic rose 10 per cent, while Old Navy -- which has previously driven Gap’s success -- posted a drop in comparable sales. Athleta’s figure was flat.

The company took a US$53 million charge for Yeezy Gap product, which it pulled from stores after ending its partnership with rapper and designer Ye.

Gross margin was 37.4 per cent, slightly below forecasts, due to higher discounting and inflationary commodity price increases, the company said. A drop in air freight expenses this year offset some of those pressures.

The performance of Gap and Ross Stores Inc., which also reported quarterly results after the close on Thursday, indicate that there’s still demand for apparel if the price is right -- even if inflation is eroding purchasing power and sending more dollars toward staples such as groceries.

Ross shares surged 12 per cent to US$110.15 at 5 p.m. in New York after posting third-quarter sales and profit that beat estimates, along with an increase to guidance. Despite economic uncertainty that is hurting consumer sentiment, “we remain confident in the off-price business model,” Ross CEO Barbara Rentler said.