May 21, 2018

GE Offers a Blueprint for Its Great Unwind

, Bloomberg News

(Bloomberg Opinion) -- The GE of the future won't look anything like the GE of the past.

The embattled industrial conglomerate on Monday announced a merger between its locomotive unit and Wabtec Corp. The deal is as complicated as it gets, with General Electric Co. first selling some of its transportation assets to Wabtec, then spinning or splitting off a portion of the business to its own shareholders and merging that piece with a subsidiary of Wabtec. The various machinations are meant to keep the deal tax-free to investors, and the net gist is that GE will receive $2.9 billion in cash and, together with its shareholders, own 50.1 percent of the combined company.

I'll come back to that cash payment. But first, it's interesting to me that despite GE and its investors ending up with a slight majority of the resulting transportation giant, the surviving entity seemingly will be called Wabtec. And it's just Wabtec, with none of the ham-handed nonsense that gave us Baker Hughes, a GE Co. Wabtec, of course, is short for Westinghouse Air Brake Technologies. The Wilmerding, Pennsylvania-based company traces its roots back to George Westinghouse, the erstwhile rival of GE patron Thomas Edison in the nasty battle for electrical-system dominance known as the "War of Currents." Oh, if Edison were alive today.

Wabtec CEO Raymond Betler will stay in his job and Albert Neupaver was reappointed as executive chairman. Rafael Santana, who replaced current GE CFO Jamie Miller as head of GE Transportation, will lead Wabtec's freight segment. GE gets to designate three independent board members, but for all intents and purposes, this will be a GE business in legacy only. There is something sad about that, and yet this is also the most logical outcome and a blueprint for a further unraveling of GE's conglomerate identity.

GE is selling its locomotive unit at a low point for the business, with the division last year recording its lowest annual revenue since 2010. The deal structure gives shareholders the ability to participate in the business's recovery. It's also tax-efficient: The transaction allows for $150 million of annual cash tax savings for the next 15 years. The first $470 million of gross benefits will be paid to GE, while the remainder (with a net present value of $1.1 billion) accrues to the new Wabtec.

It wouldn't be surprising to see GE pursue similar structures for other pieces of its business. The one investors salivate over is a potential combination of its aviation unit with Honeywell International Inc.'s aerospace division. A full-blown breakup may be the only thing that solves GE's gratuitous complexity. But executing one will require Edison-like creativity, particularly as it relates to GE's mammoth pension deficit. That brings us back to that $2.9 billion cash payment.

It's more than analysts had been expecting, but the headline valuations for GE divestitures aren't always what they appear. Take the pending sale of its industrial solutions business to ABB Ltd. The $2.6 billion price tag translates to $1.9 billion of net proceeds, partly because of deal taxes but also because some cash is going to GE Capital, which acquired accounts receivables from the industrial solutions business.

JPMorgan Chase & Co. analyst Steve Tusa pointed out earlier this month that GE's transportation and lighting businesses had a combined $175 million sitting at GE Capital Services, suggesting we may see a similar dynamic when the final details are spelled out in regulatory filings. Also missing from today's deal announcement is any sort of specifics for how pension liabilities associated with the transportation unit will be handled. The great risk in a GE breakup is that it sells off its assets to bring in cash and is left with a mountain of liabilities. The one upside in this case is that part of GE's ongoing stake in Wabtec will be held by the company directly, providing a source of future liquidity.

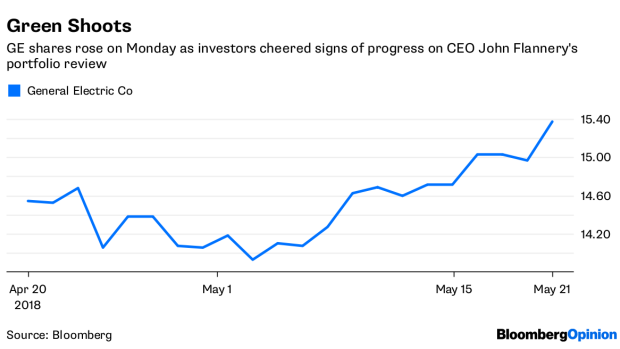

The transportation deal is the first big step in CEO John Flannery's effort to rethink GE. But the details matter.

To contact the author of this story: Brooke Sutherland at bsutherland7@bloomberg.net

To contact the editor responsible for this story: Beth Williams at bewilliams@bloomberg.net

©2018 Bloomberg L.P.