Sep 21, 2022

Germany and UK Reveal Energy Bailouts to Avert Economic Damage

, Bloomberg News

(Bloomberg) -- Germany and the UK announced energy bailouts to avoid an economic collapse and take the sting out of soaring prices, with European governments spending 500 billion euros ($496 billion) by one estimate to help consumers and businesses.

Chancellor Olaf Scholz’s administration said Wednesday it will nationalize Uniper SE, Germany’s largest gas importer. The government will control about 99% of the Dusseldorf-based utility after injecting 8 billion euros into the company and buying the majority stake held by Finnish utility Fortum Oyj.

Separately, the UK unveiled a massive bailout to help companies with their energy bills this winter. Under the estimated £40 billion ($45 billion) plan, Prime Minister Liz Truss’s government will cap the wholesale energy prices that feed into gas and power contracts for businesses for six months.

The measures are among the most prominent steps European nations are taking to ease an unprecedented energy crisis in the wake of Russia’s invasion of Ukraine. Moscow has slashed natural gas supplies to the region, sending prices of the fuel to record levels in recent months. That has forced governments to shield consumers and industries from further financial pain as winter approaches.

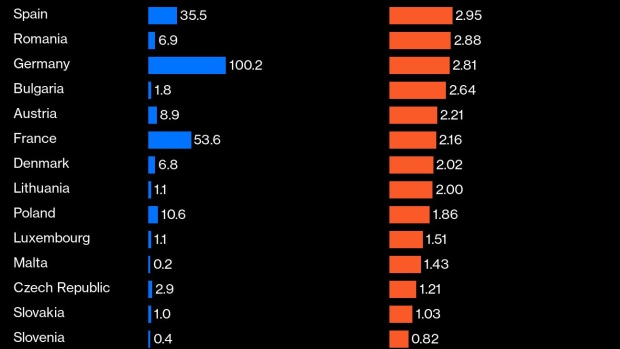

The bailouts announced in Berlin and London coincide with fresh estimates from the Bruegel think-tank that the total spend by European nations on easing the energy crisis for households and businesses is nearing 500 billion euros. The European Union’s 27 member states have so far earmarked 314 billion, not including other major spending like nationalization plans, it said.

The growing fiscal burden comes amid broader inflation and a bleak economic outlook. EU ministers are negotiating an emergency plan that will transfer windfall energy company profits to vulnerable households and firms. The deal, expected to be reached on Sept. 30, also includes a power price cap and a target to reduce electricity demand as Moscow squeezes gas flows to the region.

“Initially designed as a temporary response to what was supposed to be a temporary problem, these measures have ballooned and become structural,” said Simone Tagliapietra, a researcher at Brussels-based Bruegel. “This is clearly not sustainable from a public finance perspective.”

While Bruegel’s estimates include measures such as lower value added tax rates on electricity, subsidies for heating and measures to keep some energy companies afloat, they don’t fully reflect the scale of liquidity support across Europe and measures including the nationalization of Uniper.

“The government’s resolve and willingness to make far-reaching decisions is a guarantee that we will get through this period in good shape,” German Economy Minister Robert Habeck said Wednesday at a press conference in Berlin.

Uniper shares tumbled as much as 39%, with its market value falling to about 1 billion euros. Its nationalization is Germany’s biggest step to date to protect the country from blackouts and rationing this winter and beyond. The government is also in advanced talks to take control of VNG AG and nationalize Securing Energy for Europe GmbH, the former German unit of Russia’s Gazprom PJSC.

Read more: The Weakest Link in Germany’s Energy Security Is Fraying

The Uniper rescue also raises questions about the implementation of the German government’s planned gas levy. The temporary measure, which is supposed to take effect from Oct. 1, is designed to allow suppliers to share the burden of high prices with consumers but has prompted a public backlash.

Around a dozen companies have applied for compensation totaling about 34 billion euros, according to Trading Hub Europe, which is overseeing the levy, with Uniper guzzling most of the aid. Habeck has said he plans to revise the controversial levy to shut out company’s that aren’t affected by surging prices.

The rising costs of the energy crisis also threaten to deepen economic divergencies among EU member states, according to Tagliapietra.

“This level of intervention also entails a risk of fragmentation across Europe: governments with more fiscal space will inevitably better manage the energy crisis by outcompeting their neighbors for limited energy resources over winter months,” he said. “It is thus important to design policies that can ensure fiscal sustainability and coordinate them -- notably among EU countries.”

©2022 Bloomberg L.P.