Nov 14, 2022

Germany’s Biggest Wage Talks Keep ECB Officials in Suspense

, Bloomberg News

(Bloomberg) -- Germany’s biggest labor union is locked in talks with employers over a pay deal for about 3.9 million workers, in one the most significant domestic showdowns of Europe’s energy crisis so far.

The talks pit IG Metall and its members in the metals and electronics industry against companies represented by the Gesamtmetall employers’ association. Seeking compensation for rampant price increases, the union is making the toughest demand since 2008. The employers say they can’t afford to lift wages just as a recession takes hold.

The result will serve as an indicator of how pay might develop across the region’s largest economy, and the negotiations will be closely watched in Frankfurt by European Central Bank officials worried that significantly higher pay might risk entrenching inflation already at a historic high.

With the two sides at loggerheads, there’s also a growing risk of widespread strikes. IG Metall’s board will decide next week whether to escalate by holding a ballot on walkouts, threatening to disrupt assembly lines at firms including Airbus SE, Mercedes-Benz AG and Thyssenkrupp AG.

Here’s what you need to know:

What are German unions demanding?

IG Metall is pressing for salary increases of 8% for its members. Other unions are also agitating: Ver.di, which represents services workers, wants a 10.5% raise for the 2.5 million public-sector employees that it’s negotiating for in coming months.

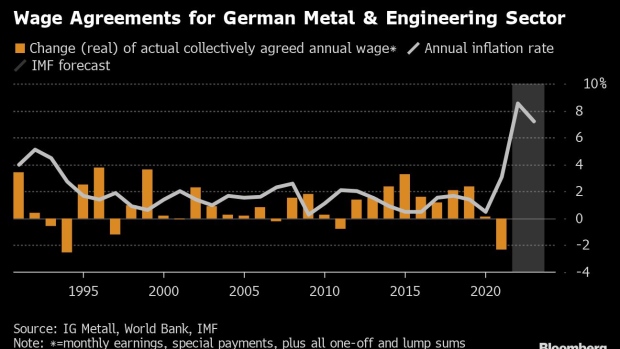

While such pay demands are the steepest in many years, Germany’s inflation rate is forecast to be even higher in 2022. Industrial workers typically need to drive to out-of-town production sites, meaning they’re more exposed to the increased cost of fuel.

What do companies say?

Unsurprisingly, the employers want to pay much less than IG Metall is asking for. Gesamtmetall wants to make a one-off €3,000 ($3,086) payment to workers, and is also seeking an agreement that they won’t have to do so again for an undetermined but lengthy period, implying several years.

The employers’ group argues that its members face threats from surging energy and material costs, as well as supply-chain disruptions related to Russia’s war in Ukraine. They also claim many companies burned through cash reserves trying to keep employees on board during the pandemic, meaning there’s not enough money available for more pay.

“The current proposals from IG Metall would lead to enormous, unmanageable burdens for many of our companies this year and next,” said Harald Marquardt, senior negotiator for the employers’ association. “I don’t see approval from our committees and members as possible.”

What are the next steps?

Widespread strike action could erupt relatively quickly.

IG Metall wants the employers’ representatives to drop the one-off payment offer, and to start bargaining over permanent salary increases. The union’s board will meet on Nov. 14 to decide whether talks are moving substantially in that direction.

If officials decide that negotiations are stalling, they’re likely to announce a ballot on Nov. 17 for strike action. That would amount to a major escalation that could shut down production lines at some of Germany’s biggest companies.

How does this usually get resolved?

In the past, labor unions have often settled for about half of their initial demand, according to JPMorgan economists. That was also roughly the outcome of an earlier negotiation in the smaller steel sector.

However, recent deals in the metals and electronics sector have been weak due to the pandemic, so workers may feel the need to catch up. Many German companies are also short on staff, partly for demographic reasons, so labor unions are now in a better position to negotiate.

What does it mean for the broader economy?

Central bankers are worried that too generous a pay deal could set off a wage-price spiral and keep inflation elevated for longer.

At the most recent ECB meeting, President Christine Lagarde singled out “higher-than-anticipated wage rises” as a key risk factor for officials’ inflation forecast. The pace of pay increases will be a factor in their judgment on when to stop raising interest rates.

Chancellor Olaf Scholz has meanwhile hosted labor unions and business representatives for talks in a bid to keep a lid on inflation. His government has introduced the option of making direct payments worth as much as €3,000 tax-free as a way to compensate employees.

©2022 Bloomberg L.P.