Feb 13, 2024

Global Banks’ German Assets Surpass €2 Trillion on Brexit

, Bloomberg News

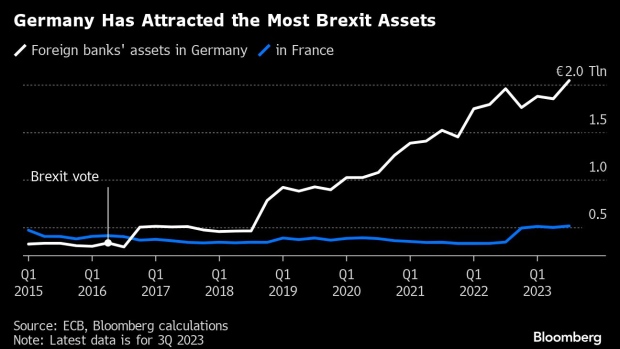

(Bloomberg) -- Global banks have increased the balance sheets of their German units to a new record as lenders move more of their business to the European Union in the wake of Brexit.

Assets held by foreign banks in Europe’s largest economy hit €2.04 trillion ($2.2 trillion) at the end of September, according to the most recent data published by the European Central Bank. That’s a sixfold increase since the UK voted to leave the EU almost eight years ago.

Germany’s financial capital Frankfurt, which is home to the ECB, has emerged as a key destination for banks looking for a new hub in the bloc after the Brexit referendum meant they couldn’t service EU clients from London anymore. The move has helped turn the city into a regulatory center, with the amount of bank assets held there soaring as a result.

About 50 firms moved to Germany in the wake of Brexit and there’s potential for more growth, Christian Lindner, the country’s finance minister, said in an interview with Bloomberg TV in London on Monday.

Read More: JPMorgan to Move Another $200 Billion in Assets on Brexit

Yet Frankfurt has failed to attract many high-paying jobs in trading and investment banking, with Paris emerging as a hub for such activities. That’s even though foreign banks’ assets in France only increased by 25% since the Brexit referendum, compared with Germany’s 500% surge.

Lindner said Germany’s financial sector “is not as good as it could be” and that he’s working on proposals to address that. Those will be ready in the second half, he said.

--With assistance from Francine Lacqua.

(Adds French increase in foreign banks assets in fifth paragraph)

©2024 Bloomberg L.P.