Jul 12, 2022

Global Finance Chiefs Head to Bali to Talk Inflation, Debt, Oil

, Bloomberg News

(Bloomberg) -- Financial stewards of the biggest economies in the world descend on the tropical island of Bali this week at a time when rapid inflation threatens to further destabilize populations and turn fragile recoveries into recession.

The Group of 20 meetings of finance ministers and central bank governors Friday and Saturday in Indonesia will focus on a bevy of issues around soaring prices, threats of more sovereign defaults, and engineering soft landings for economies still in Covid recovery mode.

Officials will have plenty more to discuss, with war raging in Ukraine and US-China tensions remaining on the boil, all while seeking to advance global initiatives around green energy, digital banking, and common tax standards.

Here’s a look at some of the top issues set to dominate the gatherings:

Inflation, Central Bank Credibility

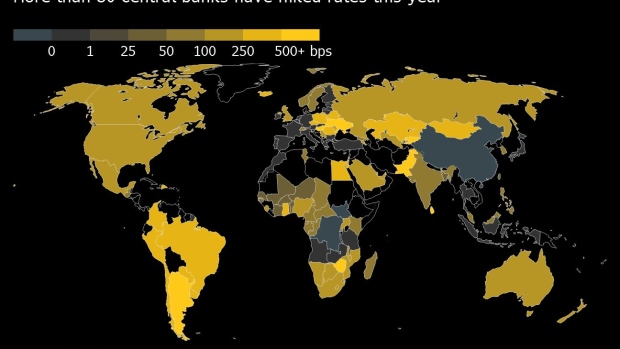

Credited for rescuing the world economy from the Global Financial Crisis a decade ago, central bankers are now under fire for having to play catch-up on fighting rampant inflation this year. More than 80 central banks have hiked interest rates this year, with “jumbo” increases of 50 basis points or more becoming more popular.

For Federal Reserve Chief Jerome Powell, the “bigger mistake” is falling further behind on inflation rather than pushing the economy into recession. Other economies have weaker fundamentals and buffers than the US, making for more volatile decisions.

Growth issues are high on the agenda for the G-20 meetings, with two of the six priorities addressing post-Covid exit strategies to support the recovery and scarring effects from the last crisis.

Many central bank governors in attendance will stay quiet this week, given blackout rules and norms around public comment with scheduled decisions coming soon. The European Central Bank, Japan, and Indonesia are among those with announcements next week. The Fed usually leaves public communication to the Treasury secretary at such gatherings.

Currency

Investors rushing to the safe-haven US dollar in a risk-off environment are triggering a cascade of capital outflows, forcing officials to weigh decisions to intervene to protect their currencies.

The issue will likely take center-stage with US Treasury Secretary Janet Yellen and her Japanese counterpart Finance Minister Shunichi Suzuki as the yen plummets.

Yellen has shown no willingness to green-light intervention to defend currencies crashing against the dollar. With a strong currency aiding the battle against imported inflation, getting any agreement beyond statements of concern and pledges to consult may be tough.

Emerging Market Pain

With limited external buffers and depleted foreign currency reserves, lower-income nations are struggling to beat back inflation as unsettled populations stoke political tension. Investors are turning increasingly cautious, pulling money out and in turn accelerating those economies’ stresses.

A soaring debt pile of $237 billion due to foreign bondholders in notes trading in distress looms over a developing-market world that’s bracing for a potential domino effect of defaults. After Russia and Sri Lanka, Bloomberg Economics now sees five economies as most vulnerable to a default: El Salvador, Ghana, Egypt, Tunisia and Pakistan.

Beijing, which became the No. 1 official lender to developing countries in recent years, has shown little enthusiasm for a new G-20 program, known as the Common Framework, meant to streamline the process of organizing creditors to act jointly with struggling debtors. That intransigence drew criticism from Group of Seven finance ministers when they gathered in Germany in May.

The yawning emerging market-developed market divide will be a talking point among the multilateral development bank representatives.

Food Security

Several countries are especially troubled by ongoing supply issues, with Egypt, Turkey, Bangladesh, and Iran depending on Russia and Ukraine for more than 60% of their wheat, according to a United Nations report published in March.

In April, during spring meetings of the International Monetary Fund and World Bank in Washington, the US Treasury convened a meeting of top international financial officials and food security experts to address the deepening crisis. Participants agreed to work out a set of common principles and a plan for action, but there has since been little visible progress.

Oil-Price Cap, Geopolitics

Having staged a walkout when Russian officials began speaking at a previous G-20 gathering, Yellen is again likely to arrive in Indonesia with a much colder stance than the host country toward the aggressor of the conflict in Ukraine.

At stake are soaring oil prices and lingering trade jams stemming from Russia’s ability to choke up global energy supply. The gathering this week will feature a mix of those whose governments have spoken out against Russia and those who remain somewhat quiet in the face of stark economic realities.

Yellen will remain firm on ideas to mitigate the risks from Russia, including an oil-price cap initiative that’s unlikely to garner enough backing, while US President Joe Biden this week will be in Saudi Arabia to pitch for a production boost.

The US and Canada have already banned Russian oil purchases, and the European Union has agreed to prohibit seaborne shipments to member countries by the end of the year, and to ban insurers from covering any tankers that carry Russian oil anywhere in the world.

The new proposal would create an exception to the insurance ban for shipments priced below an agreed cap, set just above Russia’s production costs. The aim is to limit Moscow’s revenues from oil exports, while keeping Russian oil on the market and preventing another global price spike.

A senior US Treasury official speaking to reporters in Tokyo on Tuesday said blocking exports of Russian petroleum through the insurance ban without a price-cap exception would increase the global price of oil significantly, possibly to about $140 a barrel. It’s currently just above $100 a barrel.

Country leaders at a recent Group of Seven meeting in Germany, at Biden’s urging, agreed to explore the proposal, but the plan is seen as practically and politically complex. It would require unanimous support within the EU to enact legal changes. Agreeing on a price level would also be fraught. And then there are questions over whether countries like China, India and Turkey would cooperate.

Trade

Lurking in the background on geopolitics and trade is the Biden administration’s loose pledge to announce a lifting of at least some tariffs on China instituted under the Trump White House. While the move has been advertised as another effort to bring down domestic US inflation, any further hints of a slashing of those levies will be watched, especially by the Asia-Pacific economies that are more closely linked to China.

New Global Economy

A global tax deal struck last year among more than 130 countries remains hobbled by implementation hurdles as politics intervenes, including in the US. While big new milestones are unlikely to be met at these meetings, look for smaller agreements that could be struck to move the issues forward toward eventual widespread adoption.

The agreement aims to prevent the world’s biggest companies from dodging taxes by instituting a global 15% minimum tax rate and also redistributing some taxing rights so that multinationals pay more taxes in the countries where they generate revenue, instead of only where they book profits. The deal was initially scheduled to take effect by the end of 2023, but that schedule has already been scrapped.

The “build back better” era of global economic growth recovery also has consistently pushed green-economy issues at the forefront -- even as so many economies are facing the reality of crude-oil dependence.

Digital banking and financial inclusion also score separate slots among the meeting’s half-dozen stated priorities. Those initiatives get special attention among Asian economies that have made strides on issues like central bank digital currencies and electronic payments systems -- including Indonesia and observer economies at the G-20 like Singapore and Thailand.

©2022 Bloomberg L.P.