Jan 3, 2023

Global Funds Sell Record Amount of Japan Bonds on BOJ Pivot Bets

, Bloomberg News

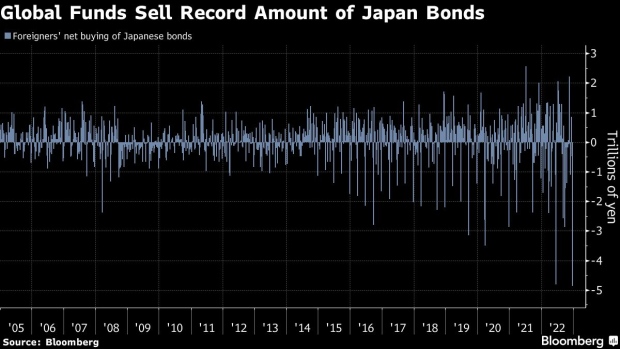

(Bloomberg) -- Bets for a Bank of Japan policy pivot are gathering pace in the bond market, with global funds offloading a record amount of the nation’s debt in the final days of 2022.

Non-resident investors sold a net ¥4.86 trillion ($37 billion) of the securities in the week ended Dec. 23, the biggest-ever withdrawal according to finance ministry data going back to 2005. The figure surpassed the previous all-time high of ¥4.81 trillion set in June.

The selling came on the heels of the BOJ’s move in December to double the cap on the benchmark yield, and hints at expectations for a further change in policy settings. Money managers such as Schroders Plc and BlueBay Asset Management are lining up wagers of a shift, putting them on course for a showdown with a central bank that remains steadfast in defending its yield curve control policy.

“Speculation of a reduction in monetary easing is more likely to grow further,” said Tsuyoshi Ueno, a senior economist at NLI Research Institute in Tokyo. “The BOJ will have to keep buying bonds” to cap the rise in yields, he said.

BOJ Governor Haruhiko Kuroda unexpectedly doubled the ceiling of the 10-year bond yield to 0.5% on Dec. 20, spurring a selloff of government debt. The central bank responded by scooping up a record ¥17 trillion of bonds last month to curb the surge in yields.

On Wednesday, the BOJ announced a fourth day of unscheduled bond-buying operations. The move was in addition to its daily offer to purchase unlimited quantities of 10-year securities and those linked to futures at 0.5%.

--With assistance from Hiroko Komiya.

©2023 Bloomberg L.P.